Caixabank (Go to Home)

Caixabank (Go to Home)CaixaBank reports a net profit of €5.79 billion in 2024, up 20.2%, and far exceeds the targets set in the 2022-2024 Strategic Plan

Gonzalo Gortázar, CaixaBank’s CEO, during the FY24 Results presentation.

Gonzalo Gortázar, CaixaBank’s CEO, during the FY24 Results presentation.

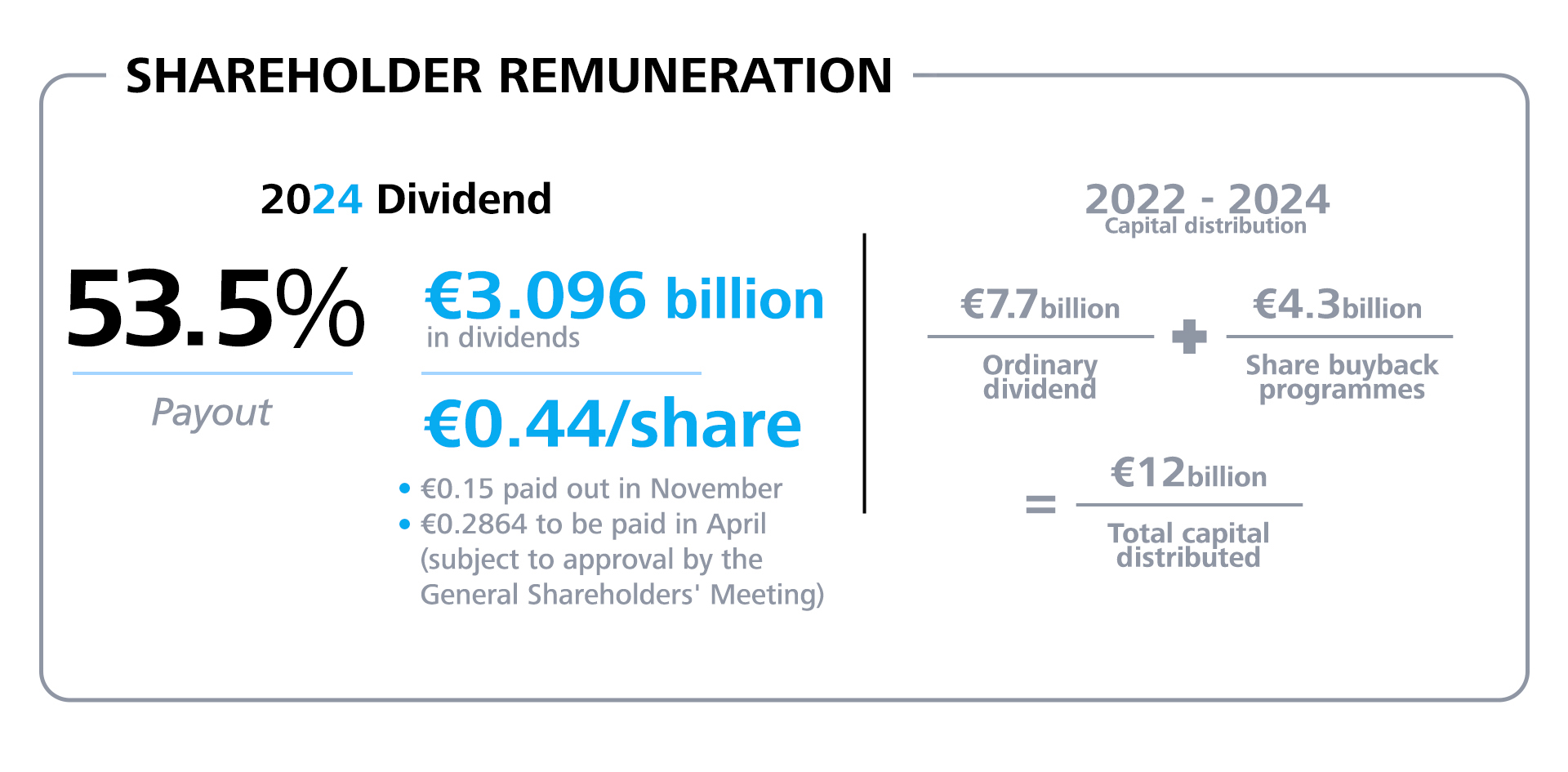

- The Board of Directors proposes to the General Shareholders’ Meeting the payment of a cash dividend of €0.2864 gross per share against 2024 earnings (€2.028 billion). This latest payment, together with the interim dividend of €1.068 billion paid out last November, brings the total payout to 53.5%.

- The board also approves a sixth share buyback programme for a total of €500 million, completing the distribution plan envisioned in the 2022-2024 Strategic Plan to reach the target of €12 billion.

- Gonzalo Gortázar, CaixaBank’s CEO, describes 2024 as “a very positive year that closes a cycle in which we have achieved all the goals we had set for ourselves in our 2022-2024 Strategic Plan: business growth, improvement in the quality of service, strict risk management and appropriate profitability recovery.”

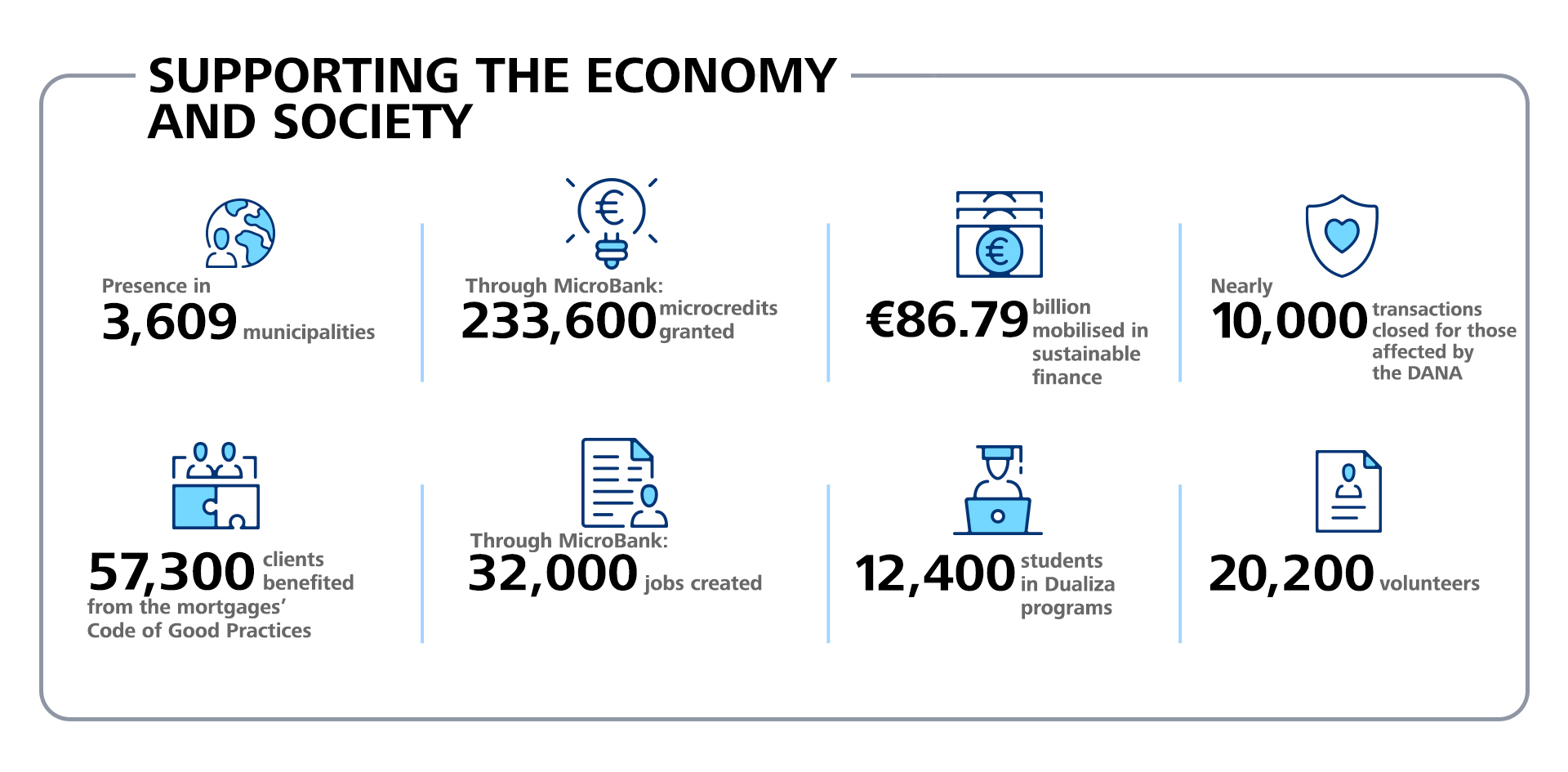

- A different approach to banking. CaixaBank’s ongoing support for the economy and society is evident in several areas, such as the promotion of financial inclusion (presence in 3,609 municipalities), the number of microcredits granted (233,600 in 2024), or the deployment of an aid plan for those affected by the DANA, in which close to 10,000 transactions were processed.

- The Bank’s results showcase its business growth and strength. Customer funds are up 8.7% during the year and the performing loan portfolio rises 2.2%, with a notable increase of 32% in new loan origination to €27.77 billion, mainly in mortgages and consumer loans.

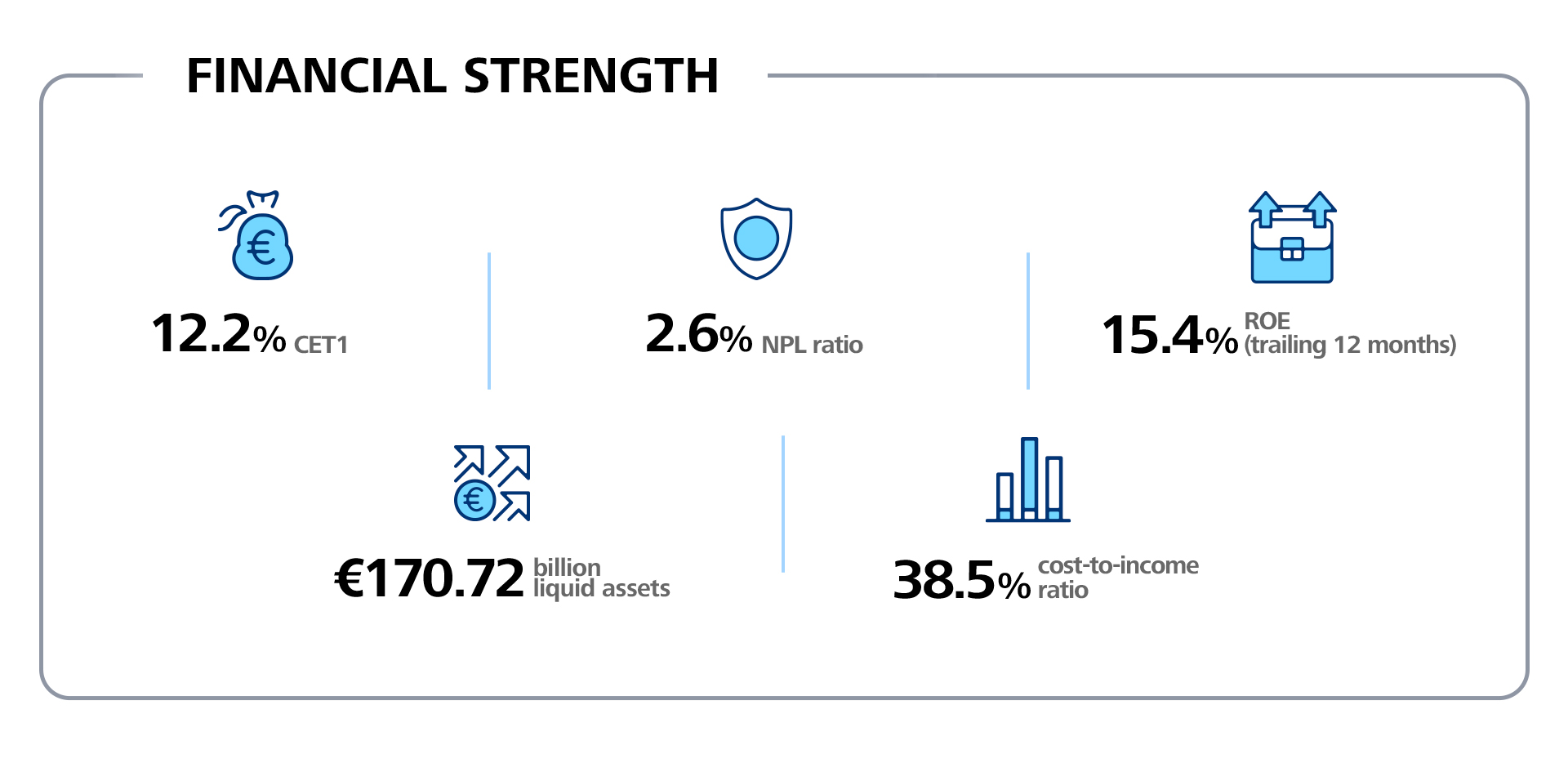

- Profitability and cost-to-income ratios continue to improve. Return on equity (ROE) stands at 15.4%, the cost-to-income ratio improves to 38.5%, and the NPL ratio has reduced to a low 2.6% at year-end.

- Change of course for net interest income in the quarter, down 1.9% on the previous quarter as a result of interest rate cuts. Despite this, net interest income for the full year improves by 9.8% to reach €11.11 billion.

- The Group has a comfortable liquidity position and strong organic capital generation. Total liquid assets amount to €170.72 billion and the CET1 ratio is 12.2%, after accounting for the impact of the fifth share buyback programme (currently in progress) and the sixth (yet to begin).

The CaixaBank Group posted a net attributable profit of €5.79 billion in 2024, compared to €4.82 billion in 2023 (+20.2%). The Group, which serves 20.3 million customers through a network of more than 4,100 branches in Spain and Portugal, has more than €630 billion in assets.

In 2024, CaixaBank successfully completed its 2022-2024 Strategic Plan and achieved the financial and qualitative objectives set for the period. The profitability, cost-to-income and NPL targets, among others, were met, as well as growth in market share in the main businesses and the promotion of social and financial inclusion.

Shareholder remuneration plan completed: €12 billion over the 2022–2024 period

The bank’s shareholder distribution capacity also far exceeded the initial challenge of €9 billion set for the 2022-2024 period, and following the decisions made by the Board of Directors, it has met its distribution target of €12 billion.

Firstly, the Board of Directors has submitted a proposal to the General Shareholders’ Meeting for the payment of a cash dividend of €0.2864 gross per share against 2024 earnings (€2.028 billion), which together with the interim dividend of €1.068 billion paid out in November 2024, brings the total amount to €3.096 billion, giving a payout ratio of 53.5%. The Board has also approved a new share buyback program (the sixth) for a total of €500 million.

Furthermore, on 29 January, the Board agreed to maintain the same dividend plan for 2025, i.e. a cash payout of between 50% and 60% of consolidated net profit, in two payments: an interim dividend of between 30% and 40% of consolidated net profit for the first half of 2025 (to be paid out in November 2025) and a complementary dividend, subject to final approval by the General Meeting of Shareholders (to be paid in April 2026).

Gonzalo Gortázar, CaixaBank’s CEO, described 2024 as “a very positive year that closes a cycle in which we have achieved all the goals we had set for ourselves in our 2022-2024 Strategic Plan: business growth, improvement in the quality of service, strict risk management and appropriate profitability recovery.”

He added that “our financial strength has enabled us to offer an attractive shareholder remuneration over the last three years, with an ordinary dividend of €7.7 billion. Of this amount, approximately €2.4 billion have been paid to the “la Caixa” Foundation, and another €1.3 billion to the FROB, thus directly reverting our profits to society.”

In November 2024, CaixaBank unveiled its new 2025-2027 Strategic Plan with the aim of maintaining sustainable profitability levels, based on three strategic pillars: accelerating growth, driving business transformation and investment, and consolidating the company’s position as a benchmark in sustainability.

Customer funds rise 8.7%, up €55 billion

The results for 2024 showcase the strength and growth of the business at CaixaBank. Business volume was consolidated at over one trillion euros, the customer base in Spain increased by 280,000, reaching 18.5 million customers. Of this total number, 71.8% are linked with three or more families of products contracted, and digital customers continue to increase, already exceeding 12 million at year-end.

Customer funds amounted to €685.37 billion, up by €55 billion, or 8.7%, compared to December 2023. More specifically, wealth management balances rose strongly by 11.7% to €263.25 billion, supported by net inflows into mutual funds and savings insurance, as well as positive market effects. Other customer funds grew by 7% in the year to €422.12 billion, including a 6.4% increase in customer deposits.

There was intense commercial activity in relation to wealth management products during the year. As a result, net inflows of mutual funds, savings insurance and pension plans continued to grow strongly, climbing from €5.34 billion to €11.41 billion during the year. CaixaBank extended its market share leadership in wealth management, claiming 29.5% of the market, widening the gap with its competitors.

The performing loan portfolio stood at €351.51 billion at the end of December, up 2.2% in the year due to the positive contribution of both loans to businesses and individuals.

With new loan origination to individuals faring well across all segments, ending the period at €27.77 billion (+32%), new mortgage production amounted to €14.38 billion, up 53% year-on-year, with around 78% of the total granted at a fixed rate, accounting for 43% of the total mortgage portfolio. In terms of consumer credit, a total of €11.98 billion was granted in 2024, up 13% in the period.

Improvement across all income statement margins

Net interest income was 9.8% higher year-on-year at €11.11 billion, driven by intensive commercial efforts and the interest rate environment in the first half of the year. However, on a quarter-on-quarter basis, it was down 1.9%, mainly due to the interest rate cuts. In 2024, some 1.2 million home mortgage customers benefitted from lower mortgage payments.

Meanwhile, revenues from services (wealth management, protection insurance and banking fees) rose by 4.6% to €4.99 billion. Specifically, revenues from wealth management grew 12.1% amid higher volumes due to prevailing market conditions and intensive commercial efforts, and revenues from protection insurance rose by 4.2%, although fee and commission income fell by 1.1% during the period, affected by loyalty schemes.

Gross income grew by 11.5% year-on-year to €15.87 billion, outpacing the increase in recurring administrative expenses, depreciation and amortisation (+4.9% to €6.11 billion). This allowed pre-impairment income to end the year at €9.77 billion (+16.1%).

The notable improvement in business activity and strict risk management can be seen in all of CaixaBank’s income statement margins, with further improvements in profitability and cost-to-income: the return on equity (ROE) was 15.4% at year-end, while the cost-to-income ratio stood at 38.5%.

Financial strength and a very low NPL ratio

The CaixaBank Group continues to reinforce its financial strength, with an NPL ratio that remains at historically low levels, coupled with a comfortable liquidity position and strong organic capital generation.

The balance of doubtful loans fell for another quarter to close December down €280 million in the year, to €10.24 billion, thanks to active risk management, with an NPL ratio of 2.6% and a coverage ratio of 69%. The cost of risk (last 12 months) stands at 0.27%.

CaixaBank also has a comfortable liquidity position, with total liquid assets having grown by €10.52 billion since December 2023 to reach €170.72 billion. The Liquidity Coverage Ratio (LCR) was 207% as of 31 December, well clear of the minimum requirement of 100%.

The Group has a strong capital position. At year-end 2024, the Common Equity Tier 1 (CET1) ratio stood at 12.2%, after accounting for the extraordinary impact of the three share buyback programmes announced in March, July and October (€500 million each, deducting 66 bps in total) and the sixth programme announced in January 2025 (€500 million, reducing the total by 22 bps), all within the broader framework of the 2022-2024 Strategic Plan. Throughout the year, the bank organically generated 219 basis points of capital.

Continued support for the economy and society

Through various initiatives related to financial inclusion, solutions with a positive social impact, social projects across the territory and a firm commitment to the environment, CaixaBank reinforced its commitment to a different way of banking and its pledge to provide ongoing support to families, businesses, and society.

Towards the end of the year, CaixaBank activated an aid plan to support those affected by the tragic flash floods. In the immediate aftermath of the flooding, the company swiftly arranged loans and advance payments, including car loans and home improvement loans, while also launching new initiatives to provide relief for the damage caused and help businesses get back on their feet, including loan deferments.

In total, close to 10,000 transactions to help those affected were processed. CaixaBank was the first bank to deploy mobile branches to the most affected areas to provide essential banking services to citizens, and the first to activate the ICO DANA credit lines for both individuals and businesses.

In terms of promoting financial inclusion, the bank is present in 3,609 municipalities across all of Spain with either a physical branch, an ATM, or a mobile branch, meaning that it has begun serving an additional 933 municipalities during the last Strategic Plan.

Meanwhile, MicroBank, Europe’s leading microcredit institution, has continued to promote financing with a positive social impact. In 2024, MicroBank granted 233,600 microcredits and helped generate 32,000 jobs over the course of last year.

Meanwhile, since the Euribor moved back into positive territory, the bank has facilitated payment agreements for loans, debt refinancings or solutions linked to the Code of Good Mortgage Practices, benefiting around 57,300 customers; all this in a year in which 1.2 million customers with mortgages on their homes saw their mortgage payments fall.

As part of its commitment to sustainability and the environment, the bank has already achieved and surpassed the target of mobilising €64 billion in sustainable finance that was set in the 2022–2024 Strategic Plan, having reached a total of €86.79 billion by the end of the year. In the realm of education, more than 12,400 students benefited from CaixaBank’s Dualiza programmes to promote dual vocational training.

Video CaixaBank's CEO, Gonzalo Gortázar