Caixabank (Go to Home)

Caixabank (Go to Home)Materiality and dialogue

Communication and dialogue are essential if we are to promote the progress of people, groups and territories.

Our way of relating to our stakeholders (customers, investors, analysts, employees, social agents and suppliers) always starts with listening to them, learning about their opinions and needs, talking to them and trying to make things happen.

In order to identify and prioritise those fields that could have significant impacts on Environmental, Social and Governance issues, we carry out an annual Materiality Study, the conclusions of which provide guidelines for the management of the Company's Sustainability Strategy and Strategic Plan, and determine the correct scale of the information to be reported.

The 2024 Double Materiality Study, which has allowed the identification of the Group's main IROs (Impacts, Risks, and Opportunities), was developed considering the requirements established by the CSRD (1) and the associated ESRS (2), taking into account the publicly available guidelines from EFRAG (3) at the time of its execution.

Double Materiality analysis

The preparation of the double materiality study relies on support from an independent expert, in accordance with a new methodology, based on new requirements in the reference standards that indicate how to carry out a double materiality approach.

- Impact materiality (from the inside out): considers the real and/or potential impacts of activities on the environment and how they affect stakeholders in the short, medium and short term.

- Financial materiality (from the outside in): considers the potential financial impact of ESG (environmental, social and governance) risks and opportunities on the Entity in the short, medium and long term.

In this regard, a subject can be material from the point of view of impacting stakeholders, from a financial point of view, or from both perspectives. This Materiality Study is presented to the Management Committee, the Appointments and Sustainability Committee, and to the Board of Directors for approval.

Phases of materiality analysis and identification of relevant aspects

The 2023 Materiality study has been carried out in four stages:

1. Context analysis

2. Identification of impacts, risks and opportunities

3. Assesment of impacts, risks and opportunities

4. Doble materiality results

Learn about the phases of the study

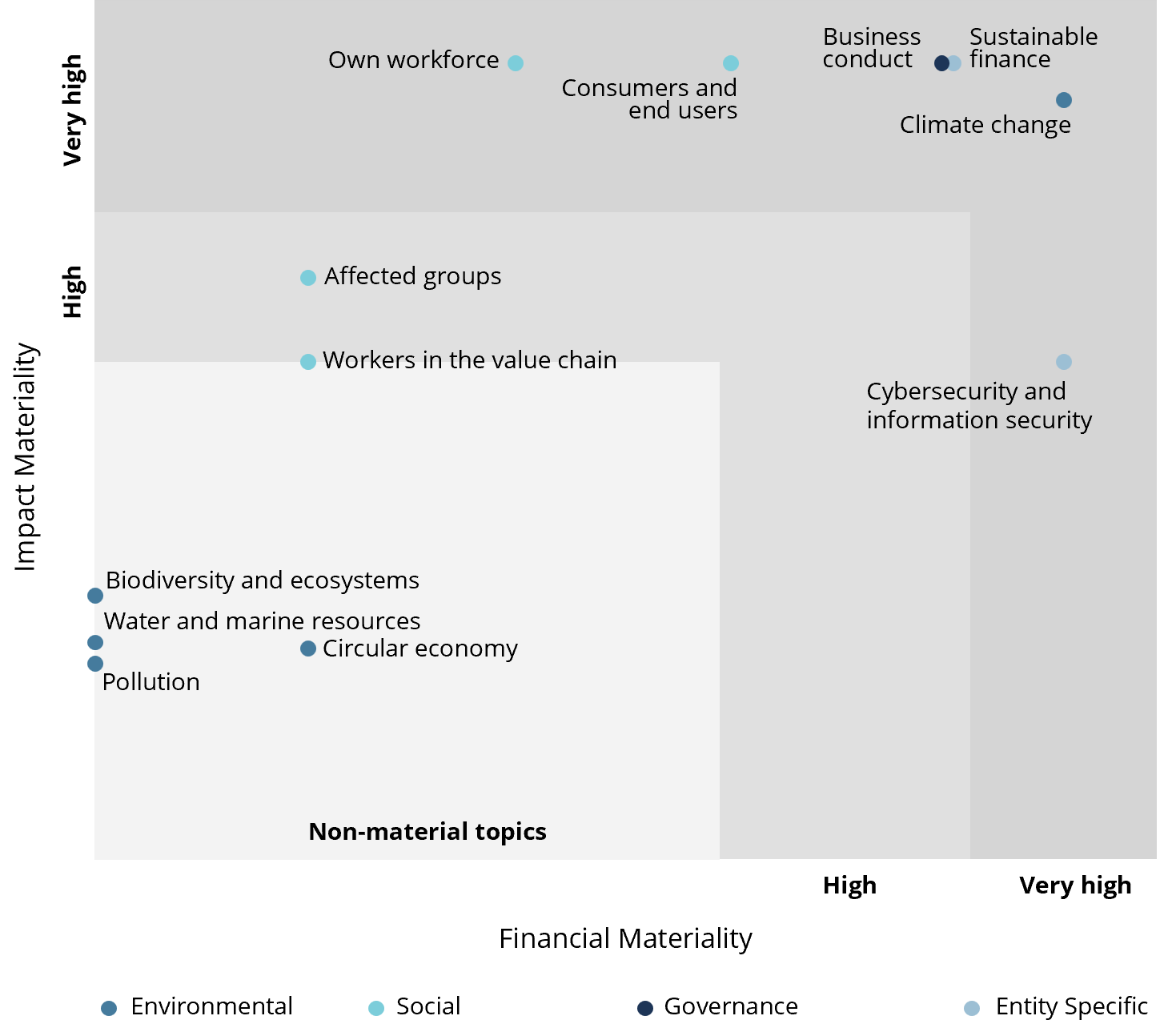

We have consolidated the overall results of prioritization for the business and for the CaixaBank and BPI stakeholders in a materiality matrix that integrates the double perspective of impact: impact of the issues on the financial situation (outside-in) and on the groups of interest and the planet (inside-out).

To determine the impact of material topics on stakeholders, surveys and direct interviews were carried out involving a wide spectrum of groups, including customers, retail shareholders, employees, suppliers and experts. In addition, for the first time a survey was conducted of the public that involved customers and non-customers (the hierarchy of the stakeholders was determined using the weights in CaixaBank's General Reputation Index (IGR)).

To determine the impact of material topics on the business, an online survey was administered to executives, members of Group companies and subsidiaries, and members and participants of CaixaBank's Sustainability Committee.

Download CaixaBank Group 2024 Materiality Matrix

Thus, the material topics on which we will have to report are:

Enviromental:

- Climate change

Social:

- Own Wordforce

- Affected communities

- Consumers and end users

Governance:

- Business conduct

Entity Specific

- Sustainable finance

- Cybersecurity

Sustainable finance and Climate change are the two topics with the greatest impact on consolidated results for stakeholders and business.

Another of the most relevant topics, especially from the perspective of financial materiality, is Cybersecurity and information security. The non-material issues, given the sector's case, have been: Pollution, Water and marine resources, Circular economy, and Workers of the value chain.

Channels for communication and dialogue

Starting from the concerns of our stakeholders and with the aim of cultivating fair relations, based on the benefit of all parties and continuing over time, CaixaBank has opted for the use of clear language and a closer, more real and more transparent way of communicating through the different systems and channels we use to reach our stakeholders.

Customers

We work to increase customer satisfaction and enhance the customer experience by implementing various communication channels and experience measurement models. These tools enable us to better understand customer needs in a more personalised manner.

The opinions of customers are mainly gathered through the Customer Experience Measurement Model, the Global Reputation Index and Materiality Analysis.

And through the Customer Contact Center and Customer Service Department, we handle enquiries and complaints from users.

Shareholders and institutional investors

At CaixaBank, we work to justify the trust that shareholders and investors have placed in us and, as far as possible, to meet their needs and expectations. To do this, we seek to offer tools and channels to facilitate communication, their involvement in the Group and the exercise of their rights as owners.

Shareholders

We offer clear, complete and accurate information to markets and shareholders, including financial and non-financial aspects of the business, and encourage informed participation at the General Shareholders Meetings.

We also organise training and information initiatives for shareholders and take their ideas into account through annual opinion surveys (Global Reputation Index and Materiality Analysis, among others). .

Information is made available to shareholders through the monthly newsletter, corporate event emails (reaching more than 200,000 shareholders), SMS alerts and other options for them to subscribe via the corporate website.

Materials for financial education are also produced and specific courses are held.

Institutional investors

CaixaBank organises roadshows and meetings with institutional investors. An investor diary has been created to provide details of significant dates in CaixaBank's corporate calendar and activities of interest to shareholders and investors.

![]()

529

Meetings with national and foreign institutions investing in equity and fixed-income

![]()

26

Meetings on ESG issues with specific investors

![]()

219

Reports by analysts on CaixaBank published, including sector reports with analyses of CaixaBank

Suppliers

The continuous improvement of relations with suppliers is key to creating value at CaixaBank. We therefore seek to establish quality relationships with suppliers who share our ethical principles and social commitment.

In line with our business strategy, the aim is to obtain goods and services of the quantity and quality we need, within an acceptable timeframe, at the lowest total cost and with the minimum risk for our business, according to responsible, sustainable procurement practices and applying unified criteria for the whole Group.

In 2024, we conducted a review of the various phases of the Purchasing and Supplier Management process, aiming to further strengthen the integration of ESG criteria at each phase. These aspects are in addition to the economic and technical criteria that will be considered when selecting the best supplier.

The management of procurement through electronic negotiation reflects CaixaBank's desire to guarantee traceability and integrity in the contracting process.

Electronic negotiation begins with the approval of all the suppliers involved and ensures that, during the process, information will be the same for all participants and selection will be based on objective criteria.

Since 2020, new certifications have been taken into account when approving suppliers with regard to corporate social responsibility: OHSAS18001/ISO45000 certification and SA8000/BSCI/Responsible Business Alliance certification and/or social audit. Contracts with suppliers also include a specific clause dealing with Human Rights.

Suppliers certified in social and environmental management

% of purchase categories with an environmental impact have environmental requirements

Employees

CaixaBank's internal communication focuses mainly on:

Promoting and tackling the Strategic Plan's challenges and business priorities.

Transmitting our corporate values as a differentiating factor.

Recognising and reinforcing good professional practice.

Promoting our corporate culture and the pride of belonging.

CaixaBank staff have a new social intranet, PeopleNow, which constitutes a lever for Digital and Cultural Transformation, encouraging participation by employees, improving their experience and working towards modern, visual, multi-platform, participatory communication (mobile-first).

It brings together business, corporate and social content in a smart, modern space in which all staff have a profile to develop their personal “brand” and participate in communities according to their area of influence, as well as subscribing to information channels according to their interests.

We also set up external committees with workers' representatives, hold face-to-face training, biannual opinion surveys and follow-up surveys, and we have a programme for the induction of new employees, CaixaBank Experience, and a confidential channel for queries and complaints regarding the Code of Ethics.