Caixabank (Go to Home)

Caixabank (Go to Home)Proximity and accesible banking

We understand financial inclusion from the perspective of proximity and accessibility, and aspire to become a benchmark in banking for all our customers. Our goal is to create an omnichannel experience that deletes any physical or sensory barriers.

Being close to our customers is a priority, and this is why we believe that proximity and accessibility are two concepts that go hand in hand. We work to ensure that our channels are used by as many people as possible, removing barriers that may limit their use.

Design of our products and services

![]()

Perceptible

Senses

Information must be presented in such a way that everyone can detect and interpret it

Operable

Motor, voice

Interactive elements must be usable by anyone

![]()

Understandable

Cognitive

The content must be clear and easy to understand

![]()

Robust

Technology

The content needs to be compatible with various assistive technologies, both current and future

Accessibility of our services

We work to make our branches, ATMs and online services accessible so that interacting with us is as easy as possible. CaixaBankNow, the online banking channel accessible via web and mobile, brings all the bank's digital services together under a single concept. At the close of 2024, we reported 12.1 million digital customers.

CaixaBank has a presence in 2,234 towns and cities in Spain, with a total of 11,335 ATMs and 3,825 branches. We work to meet the challenges of the environment by removing physical and sensory barriers and adapting our developments to the senior segment.

Data at the close of 2024

% of Spanish towns of >5,000 inhabitants have a branch in their area

Spanish towns where we are the only bank

% accessible ATMs and with help videos available in sign-language

% of citizens have a branch in their municipality

people served by mobile branches in another 1,294 towns

% of CaixaBank branches are accessible

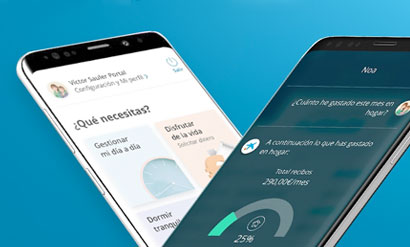

Development of accessible apps

Using the WCAG 2.0 accessibility guidelines, we design our apps to include VoiceOver navigation (iOS) and TalkBack (Android) for the rendering of all information and screen actions in speech. We also have biometric identification access. As regards content, plain and simple language is used, adding explanatory elements when more technical or legal language is required, to comply with the B2 level of comprehension.

Digital channel accessibility

The corporate portal complies with the AA accessibility level of the W3C-WAI Web Content Accessibility Guidelines 2.0. It is the sole commercial banking portal with this accreditation. This ensures accessibility in terms of elements such as colour contrast, text size, images and layout. ILUNION carries out half-yearly audits to detect any possible problems.

Cards with Braille system

We launched Spain's first Visa card with Braille reading and writing code in order to make it easier for the visually impaired to make purchases in all kinds of stores without having to give their card details to anyone. The solution has been developed in partnership with ONCE and Visa. Furthermore, our cards have a notch to help position them correctly in POS terminals and ATMs.

We offer a more personal and accessible model through our 926 Store branches , with extended opening hours until 6:30pm from Monday to Thursday and and Friday from 8:30am to 2:30pm. Currently, in Spain, there are centres in Barcelona, Valencia, Madrid, Ibiza, Burgos, Castellón, Segovia, Pamplona, Santa Cruz de Tenerife and Las Palmas de Gran Canaria. Also, thanks to the inTouch model , more than 12,1 million digital customers in Spain can undertake their transactions remotely and contact their personal manager.

Mobile branches, ofibuses

In order to provide access to the physical branch network to all customers in rural areas and to the senior group, we have committed to maintain our presence in those municipalities in which we are the only banking entity.

In addition, to strengthen the service in rural areas, we have 28 mobile branches (ofibuses) that serve over 644 people in 1,294 towns across 17 provinces: Ávila, Barcelona, Burgos, Castellón, Ciudad Real, Girona, Granada, Guadalajara, La Rioja, León, Lleida, Madrid, Palencia, Tarragona, Segovia, Toledo, and Valencia.

Each mobile branch covers different daily routes and, depending on the demand, visits the locations where it provides service once or several times a month. In addition to preventing the financial exclusion of rural areas, this service preserves the direct relationship with the customers who reside in these locations, upholding the commitment to the senior and agricultural and livestock sectors.

mobile branchers (includes 4 in reserve)

km/month

% of users over 65 years old