Caixabank (Go to Home)

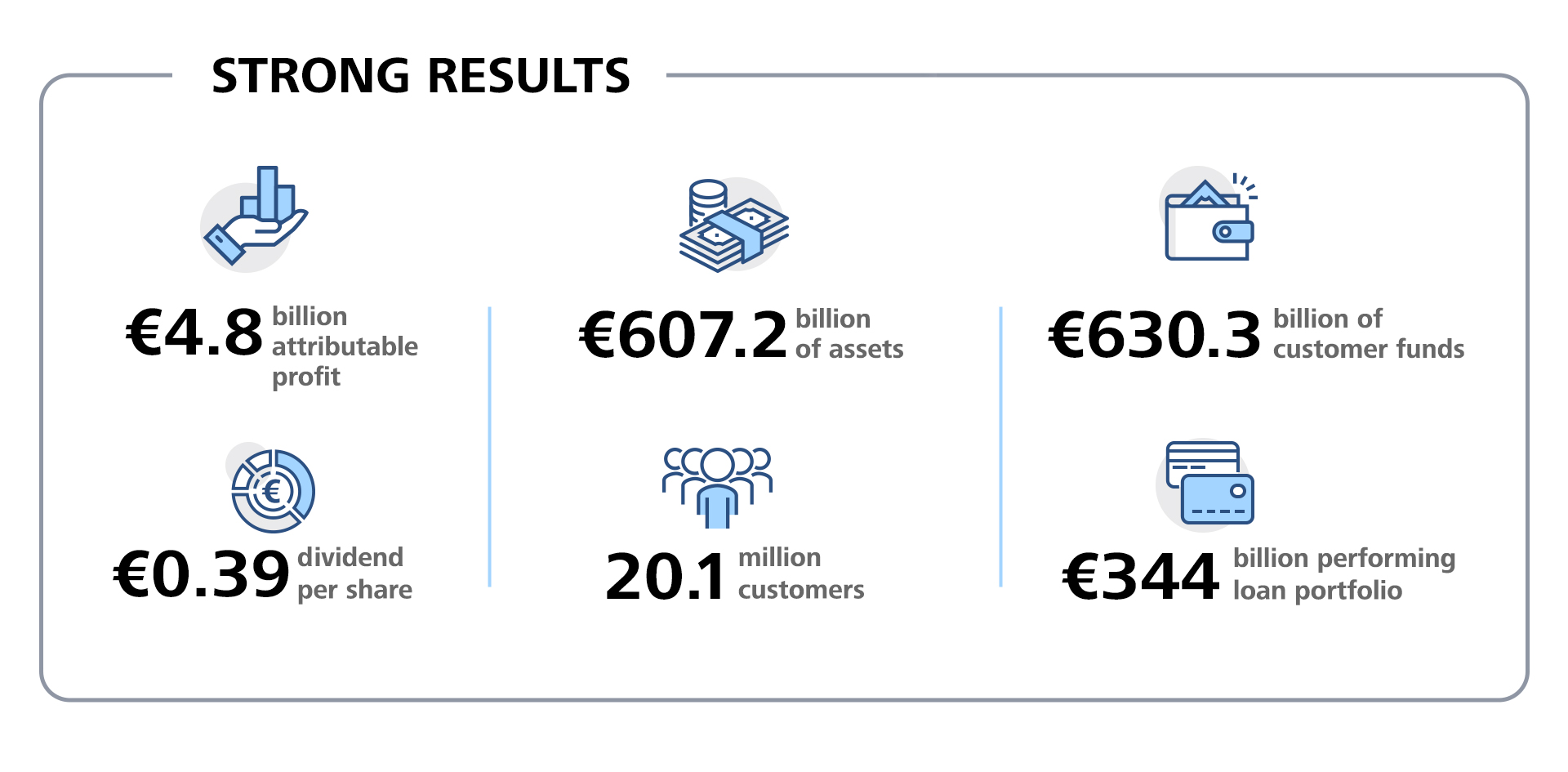

Caixabank (Go to Home)CaixaBank posts a profit of €4.82 billion in 2023, up +53.9%, and will pay a dividend of €2.89 billion

José Ignacio Goirigolzarri and Gonzalo Gortázar, president and CEO of CaixaBank respectively.

José Ignacio Goirigolzarri and Gonzalo Gortázar, president and CEO of CaixaBank respectively.

- Board of Directors submits a proposal to the General Shareholders’ Meeting for the payment of a cash dividend of €0.3919 gross per share against 2023 earnings, representing a cash pay-out of 60%. In addition, CaixaBank also plans to launch a new share buyback programme in the first half of 2024, as a further demonstration of CaixaBank’s financial strength.

- José Ignacio Goirigolzarri, Chairman of CaixaBank, highlights that “throughout 2023, CaixaBank has continued to support clients, businesses, and families by financing their projects and managing their savings. And all this, through a business model that is committed to financial inclusion and supporting the most vulnerable segments of society”.

- Gonzalo Gortazar, CEO of CaixaBank, remarks that “in an environment marked by the normalization of interest rates, we have capitalised on the scale and competitive position achieved with the merger. Our efficiency, profitability, and shareholder remuneration have been soundly improved, as well as our contribution to the Welfare Projects of “la Caixa” Foundation”.

- Gross income grows +28.3% in the year to €14.23 billion, driven by net interest income (+54.3%), income from insurance services (+19.6%), and equity investments (+26.4%), offsetting lower fees and commissions (-5.1%).

- Growth in total business volume (including performing loans and customer funds). Customer funds increase to €630.33 billion (+€19.03 billion in the year), while the performing loan portfolio stands at over €344 billion.

- Strong commercial activity throughout the year. Net inflows into mutual funds, savings insurance, and pension plans reach €5.34 billion, up +34% year-on-year. New production of protection insurance also grows, +7% to €739 million.

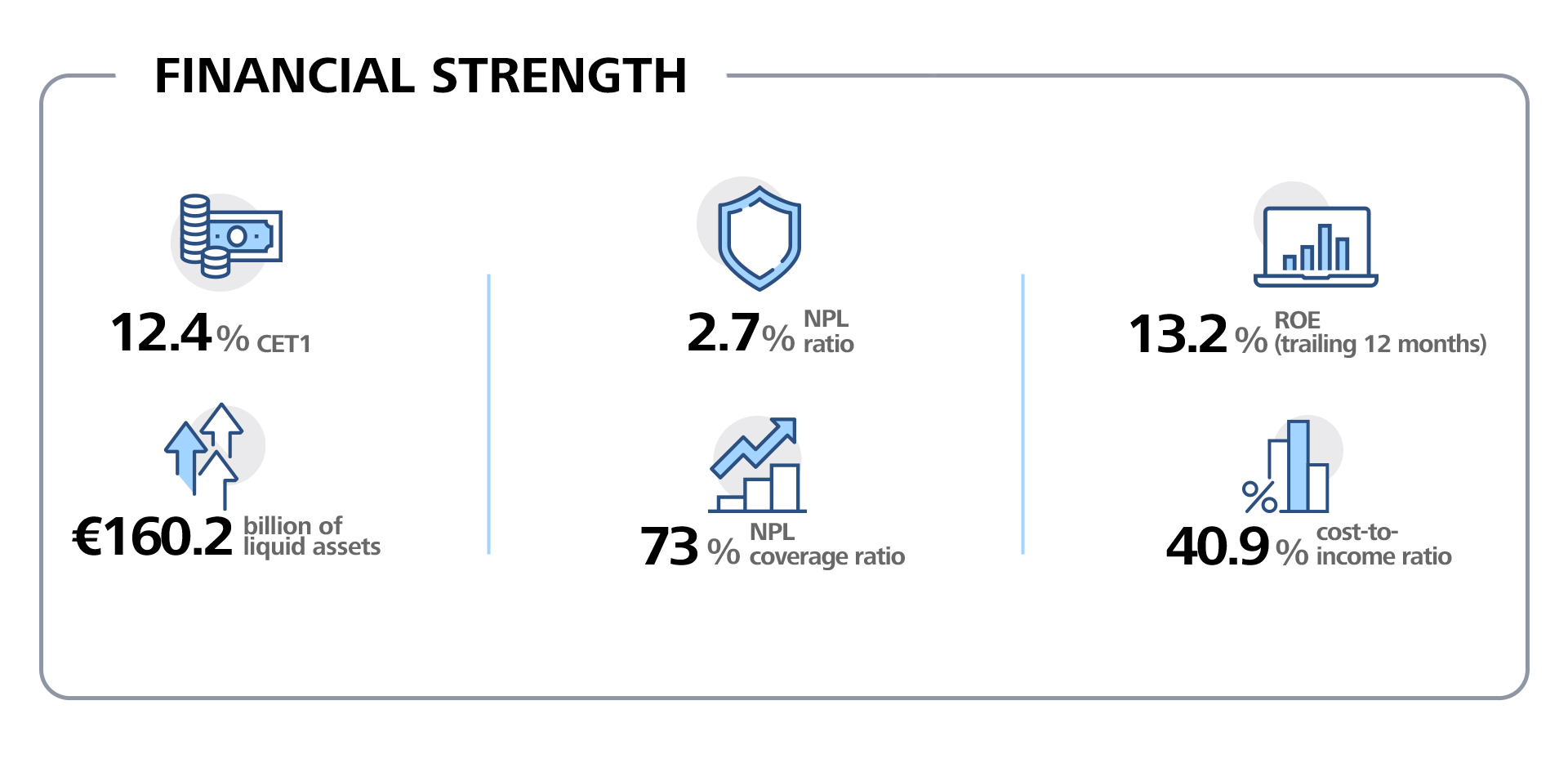

- Profitability and cost-to-income ratios continue to improve. Return on equity (ROE) at 13.2% and cost-to-income ratio down to 40.9%.

- NPL ratio under control at 2.7% at the end of the year, with a solid coverage ratio of 73%.

- Consistently strong liquidity and capital, with €160.2 billion in liquid assets following the early repayment of TLTRO III and CET1 capital ratio at 12.4%.

CaixaBank Group posted an attributable net profit of €4.82 billion in 2023, up +53.9% vs. the €3.13 billion reported in 2022. The Group serves 20.1 million customers through a network of around 4,200 branches located across all of Spain and Portugal and has more than €600 billion in assets.

José Ignacio Goirigolzarri, Chairman of CaixaBank, highlighted that “throughout 2023, CaixaBank has continued to support its clients, businesses and families, by financing their projects and managing their savings. And all this, through a business model that is committed to financial inclusion and supporting the most vulnerable segments of society”.

“This unique way of banking allows the Board of Directors to propose the payment of a dividend worth €2.89 billion, half of which will be reverted to society through ”la Caixa” Foundation and the FROB”, Goirigolzarri added.

Gonzalo Gortazar, CEO of CaixaBank, underscored that “in an environment marked by the normalization of interest rates, we have capitalised on the scale and competitive position achieved with the merger. Our efficiency, profitability and shareholder remuneration have been soundly improved, as well as our contribution to the Welfare Projects of ”la Caixa” Foundation”.

Gortazar highlighted that “in a highly challenging environment, we have completed a very positive year in terms of commercial activity performance: we have granted 280,000 loans to businesses and 80,000 new mortgages to families, while also continuing to grow our relational customer base, which now stands at 71.5%”.

Income statement evolution

CaixaBank’s 2023 income statement reflects the Group’s financial strength, showing significant growth across all margins, in a context of normalization of interest rates, and with very positive commercial dynamics.

The increase in core revenues (+31.6% in the year) to €15.14 billion stands out in 2023, driven by net interest income, which grows to €10.11 billion (+54.3%), with support from the positive impact of the new interest rate environment on the banking business, and also the excellent work carried out by the commercial network. This satisfactory performance offsets the decline in net fees and commissions (-5.1%). Specifically, recurring banking fees dropped by 9.4% year-on-year following the end of cash custody fees on corporate deposits and the discounts applied under customer loyalty programmes.

Gross income ended 2023 at €14.23 billion, up +28.3% year-on-year, driven by NII, insurance service result (+19.6%) and income from equity investments (+26.4%). Meanwhile, personnel and general expenses increased during the year (+4.7% and +6.1%, respectively).

The positive evolution of the income statement enabled the Group to achieve a return on equity (ROE) of 13.2%. The cost-to-income ratio also improved once again by falling to 40.9%, more than 9 percentage points lower than a year ago (50.3%).

Growing business volume

Business volumes at CaixaBank remained solid throughout the year. Customer funds stood at €630.33 billion at 31 December, up +€19.03 billion in the year (+3.1%). On-balance sheet funds amounted to €463.32 billion, growing +1.2% in the year underpinned by the increase in savings insurance. Time deposits at €54.7 billion, +109.4% in the year, driven by the interest paid on deposits.

Assets under management stand at €160.83 billion (+8.7% in the year), supported by market conditions and significant inflows in savings and investment products. Net inflows in mutual funds, savings insurance and pension plans amounted to €5.34 billion, up +34% vs. 2022, while CaixaBank’s combined market share in long-term savings and deposits ended the year at 26.2%.

CaixaBank also reported growth in new production of protection insurance, up +7% to €739 million.

In terms of loans and advances to customers, the Group’s performing loan portfolio exceeded €344 billion at 31 December, with growth in both corporate and consumer segments and reduction in residential mortgages.

With regards to new production during the year, new mortgage loans amounted to €9.38 billion, with a remarkably strong performance in the fourth quarter. As for consumer lending, new production totalled €10.33 billion in 2023, while new business loans stood at €37.01 billion, both with a strong performance as towards the end of the year.

Sound risk management

CaixaBank pursued an active and prudent risk management policy in 2023, which enabled it to keep the NPL ratio stable during the year (2.7%) while reducing its non-performing loans by €175 million to €10.52 billion. Meanwhile, total provision funds for insolvency risk amounted to €7.67 billion and the coverage ratio was broadly unchanged versus year-end 2022 at 73%. The cost of risk remained low (0.28%, trailing 12 months).

Liquidity and capital position at optimal levels

The Group closed 2023 with optimal levels of both liquidity and capital, in line with the progress achieved throughout the year. Total liquid assets stand at €160.20 billion at 31 December, up €21.19 billion in the year.

And all this, following the full early repayment of the outstanding TLTRO III balance which results in zero-balance drawn under the ECB credit facilities. Meanwhile, the Group’s Liquidity Coverage Ratio (LCR) was 215% at the end of the year, reflecting a comfortable liquidity position.

In terms of capital, the Common Equity Tier 1 (CET1) ratio stood at 12.4%, with organic capital generation of 201 basis points in the year.

Attractive shareholder remuneration in line with the Strategic Plan

CaixaBank’s Board of Directors will propose to the General Shareholders’ Meeting the payment of a cash dividend amounting to €0.3919 gross per share against 2023 profits, representing a cash pay-out of 60% to be paid in April. This is equivalent to a total payment to shareholders of €2.89 billion.

The dividend will be channelled back into society, since around 50% of this amount will be paid to ”la Caixa” Foundation, which carries out its Welfare Projects, and to the Spanish State, through the FROB (Spanish Fund for Orderly Bank Restructuring). In addition, 590,000 retail shareholders shall also benefit from the dividend.

The Board has also approved the dividend plan for 2024, including a cash pay-out target of between 50% and 60% of consolidated net profit, payable in two cash payments: an interim dividend to be paid in November of between 30% and 40% of the consolidated net profit for the first half of 2024, and a complementary dividend payable in April 2025, subject to final approval by the General Shareholders’ Meeting.

CaixaBank also intends, subject to regulatory approval, to launch a new share buyback programme during the first half of 2024, aimed at bringing the year-end 2023 %CET1 closer to 12%.

Commitment to financial inclusion

CaixaBank, with the largest network of branches and ATMs in Spain, remains firmly committed to financial inclusion, and is present through physical branches in more than 2,200 towns and cities across the country. Thanks to this extensive network, the Bank is able to reach practically every corner of the territory and, notably, it is the only bank in 483 municipalities, which it has also pledged not to abandon. In addition, CaixaBank has more than 11,000 ATMs throughout Spain.

Aside from its network of branches and ATMs, CaixaBank operates various mobile branches, which provide face-to-face banking services to a total of 783 rural communities. In 2024, CaixaBank has already managed to increase the financial services it provides through its mobile branches by 23% compared to the start of 2023, when the service visited 636 towns and villages.

This service allows users, whether or not they are customers of the bank, to carry out the most common banking transactions, including withdrawing cash, making deposits, paying bills, and taxes in locations without a bank branch or with other restrictions limiting access to financial services.

Social support endeavours

Financial strength allows CaixaBank to offer adequate remuneration to the bank's shareholders while continuing with its commitment to support families, businesses, the wider economy, and fulfilling its valuable social role.

Indeed, in 2023 CaixaBank has granted more than 280,000 loans to businesses and 80,000 mortgages to families. On the other hand, since interest rates began to rise, more than 30,000 refinancing transactions, conversions of floating-rate mortgages to fixed-rate, and accessions to the Code of Good Practices for mortgage holders have been processed.

The Bank has more than 10,000 social housing units and around 360,000 customers with social or basic accounts.

Video CaixaBank's chairman, José Ignacio Goirigolzarri

Video CaixaBank's CEO, Gonzalo Gortázar

Quote from CaixaBank's chairman, José Ignacio Goirigolzarri