Caixabank (Go to Home)

Caixabank (Go to Home)CaixaBank is the digital banking leader in Spain, according to GfK DAM

CaixaBankNow has been one of the most downloaded 'apps' in Spain in 2022.

CaixaBankNow has been one of the most downloaded 'apps' in Spain in 2022.

GfK DAM provides official values for digital consumption in Spain and analyses traffic figures for the websites and apps of financial entities

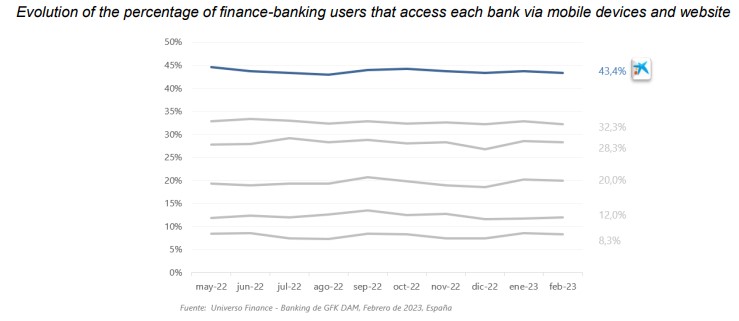

- CaixaBank ranks as the digital bank with the most unique digital users in every channel, with 43.4% of the market in the ‘banking’ universe.

- The company's strength is especially remarkable in the field of mobile technology thanks to CaixaBankNow, one of the most downloaded apps in Spain in 2022, and to imagin, the mobile-only platform with digital services and lifestyle options.

CaixaBank leads digital banking in Spain with a market share of 43.4% in the ‘banking’ universe, according to figures reported by GfK DAM, the official provider of digital consumption data in Spain.

The figures from February 2023 for traffic to the websites and apps of banks that are active in Spain show that CaixaBank ranks as the digital bank with the largest number of digital users in all channels.

With respect to 2023, the GfK DAM data shows a stable trend in the market shares of the various banks active in Spain. In CaixaBank's case, the available data positions it ten points above the second-ranked bank with higher market penetration.

CaixaBank is also the leader in both the mobile and traditional website channels: The company's strength is especially remarkable in the mobile channel, with a market share of 38%. This includes CaixaBankNow,the reference application for CaixaBank customers,and imagin,the mobile only platform with digital services and lifestyle options. With regards to the website channel, CaixaBank is the clear leader, with a 34.3% share.

CaixaBank has the largest userbase in digital service channels of all financial institutions in Spain, with 11.2 million customers.

CaixaBankNow: digital banking that facilitates interaction with the in-person service

During 2022, CaixaBankNow was ranked among the Top-30 most downloaded apps in Spain, considering all categories. Furthermore, in the Finances ranking, two of the three most downloaded apps in the country belong to the bank: CaixaBankNow and CaixaBank Sign (the specific application for digitally signing transactions).

CaixaBankNow is designed to provide the same service level as customers receive in the branch network online, including taking out financial products; digitally signing transactions; using mobile payment services for paying and financing purchases; activating and blocking cards; and sending money via Bizum, among many other options. In addition, CaixaBankNow has been adapted to meet the changing needs of businesses.

Among the highest rated features of CaixaBankNow are the tools that facilitate interaction between the in-person and online service: for example, customers can initiate the process of taking out a product at a branch and complete it by signing it at home, after reading at their leisure the documentation uploaded to their personal area in the digital banking service. Alternatively, customers can search for information about a certain product on the online service channel and, then, take it out at their habitual branch or through a remote adviser that will call whenever it is most convenient for them. CaixaBank's digital banking service also facilitates communication with branch advisers through messages on the Wall or via videoconference, and it allows users to schedule a face-to-face appointment while viewing the adviser's schedule in real time.

CaixaBankNow has been named the "Best Consumer Mobile Banking App in Western Europe" by the US magazine Global Finance in 2021, 2020 and 2018; and in the world in 2019. In addition, in 2022, Global Finance named CaixaBank the "Most Innovative Financial Institution of Western Europe " and "Best Bank in Spain in 2022.". CaixaBank's use of big data and artificial intelligence made it a worthy winner of the award for "Best Bank in the Analytics and AI category 2022 " at the Banking Innovation Awards of Qorus-Accenture.