Caixabank (Go to Home)

Caixabank (Go to Home)Social banking, the great ally of impact investing

Social banking, the great ally of impact investing.

Social banking, the great ally of impact investing.

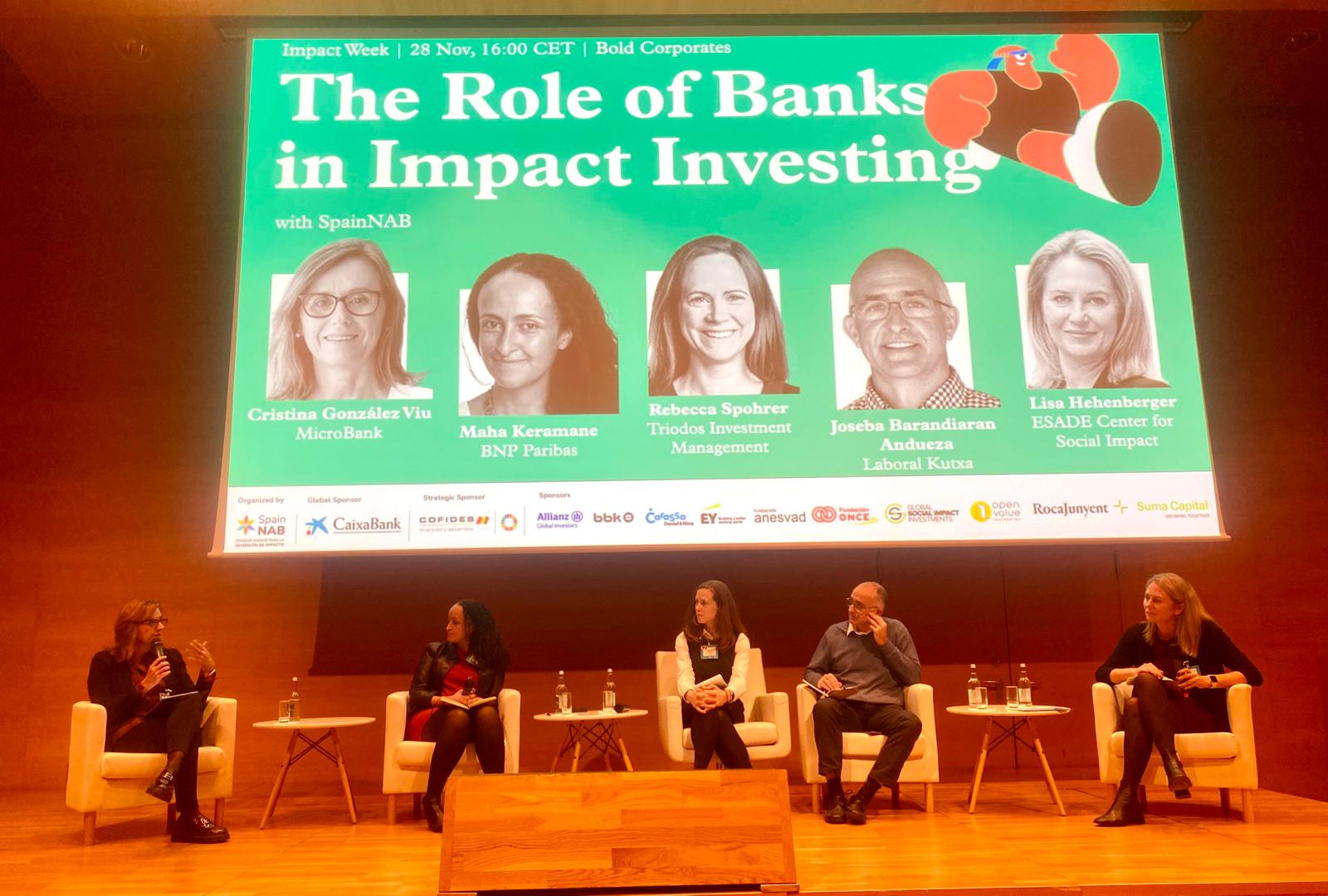

The recent staging of Impact Week 2024 in Bilbao provided the ideal backdrop to showcase the immense value of impact investing. Far from being an unusual term, impact investing happens to be booming, with €1.517 billion in assets under management in Spain alone in 2023, 26% more than the previous year, according to a report drawn up by SpainNAB and Esade Center for Social Impact.

This data shows that this type of investment has permeated the economic ecosystem and established itself as an effective and powerful tool to help address current challenges in areas such as inequality, poverty and environmental protection.

The agents involved in impact investing are numerous and diverse, from public instruments to SMEs and entrepreneurs, including third sector entities and, of course, social banks, such as MicroBank, CaixaBank’s social bank. The bank was represented at Impact Week by its CEO, Cristina González. Over the course of the event, national and international experts presented various success stories and debated and shared ideas on how the financial sector can become a driver of social and environmental change. Impact investing, green finance and social innovation naturally took centre stage during the debates.

MicroBank is fully committed to social impact and for this reason one of its strategic pursuits is measuring this impact. Measuring the results reveals potential risks while also showcasing the fruits of the bank’s efforts, thus allowing it to further improve and amplify its social impact moving forward.

MicroBank’s impact measurement work has shown that the bank helped to create 662 direct jobs in the Basque Country alone in 2023 through the numerous entrepreneurs and microenterprises that received a microcredit from the bank. For Spain as a whole, the contribution to employment amounts to more than 28,500 direct jobs. Moreover, thanks to the drag-along effect of its activity, the businesses supported by MicroBank contributed €4.468 billion to the Spanish economy last year, equivalent to 0.3% of Spanish GDP.

MicroBank granted more than €32 million in social impact financing in the Basque Country in 2023, 27.3% more than the previous year. These microcredits allowed 2,613 projects to happen and helped startups and vulnerable families pursue their goals in relation to the social economy, education, health, entrepreneurship and innovation projects in the Basque Country. It is precisely in this territory where MicroBank has helped to turn projects with a heavy environmental component into a reality. A good example would be the local energy communities (in the town of Zumárraga, for example), which have been backed by MicroBank with the support of the European Investment Fund (EIF). This kind of venture is a testament to the value of public-private partnerships in championing clean energy generation and illustrates the advantages it offers both for businesses and residents, who benefit from significant savings on their electricity bills.

Impact investing will continue to grow and social banking plays a key role by channelling funds towards projects that not only seek economic profitability, but also look to generate social and environmental benefits, thus contributing to fairer and more sustainable development.