Caixabank (Go to Home)

Caixabank (Go to Home)New economic scenario: cautious optimism in a context of uncertainty

New economic scenario

New economic scenario

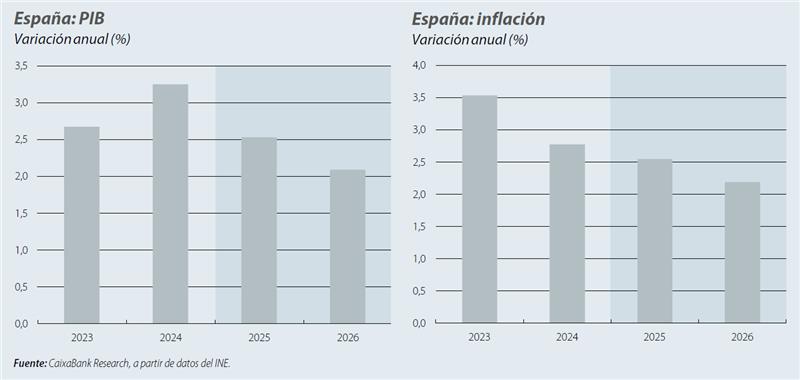

According to the new economic scenario prepared by CaixaBank Research, the Spanish economy will continue to grow at a very good rate until 2024. In Q4 2024, GDP grew by 0.8% quarter-on-quarter, driven by an increase in private consumption and investment, once again significantly outpacing the euro area as a whole, which remained flat quarter-on-quarter. On this basis, the economy grew by a remarkable 3.2% in 2024 as a whole.

Growth throughout 2024 was driven mainly by domestic demand. Of the 3.2 GDP growth points, private consumption contributed 1.6 p.p., supported by the good performance of the labour market and strong demographic growth, while public consumption contributed 1 p.p. more. Furthermore, the external sector contributed 0.4 p.p. to growth thanks to the good performance of services exports and the moderate level of imports, although its contribution declined during the year. The good result in 2024 is even more impressive when we consider that this growth took place in a context of still high, albeit already declining, interest rates and anaemic growth in our main European trading partners.

The starting point is good, not only because of the latest growth figures, but also because of the absence of clear financial imbalances. The current account recorded a surplus in 2024 for the thirteenth consecutive year. This continuous improvement has allowed the net international investment position - which measures the difference between financial assets and liabilities versus the rest of the world - to reduce its debit balance to below 50% of GDP (97.5% of GDP in 2009). Similarly, private debt (households and non-financial corporations) remains contained at 125.1% of GDP according to the latest data from Q3 2024, below the euro area average of 153.5%, and government debt has also continued to fall, reaching 101.8% in December 2024, 3.3 p.p. less than the previous year.

The strength of growth in the latter part of 2024 has a mechanical impact on the growth forecast for 2025. For example, even if the economy were to stagnate throughout 2025 at the level of GDP at the end of 2024, annual growth in 2025 would still be 1.2%, as the starting point is higher than the average GDP level of the previous year.

Review of the scenario's underlying assumptions

The scenario's underlying assumptions regarding the trajectory of the ECB's monetary policy, energy prices and the exchange rate remain in a direction that reinforces the narrative of consumption and investment as engines of growth to the detriment of external demand.

First, our scenario foresees a gradual moderation in underlying inflation in the euro area as a whole, reaching 2% by the end of 2025. The trajectory of inflation will allow the ECB, in a context of weakness in the euro area, to continue to gradually reduce the reference rates until the deposit rate reaches 1.75% (the lower end of the range considered neutral) in the last half of 2025.

Second, we expect the price of a barrel of Brent crude to fall slightly: we expect the price to average around $76 per barrel in 2025 ($74.5 in the previous scenario), slightly below the $79.8 average in 2024. However, the impact on the Spanish economy will be limited by the depreciation of the euro. The greater decoupling of monetary policies on both sides of the Atlantic, with the ECB continuing to cut interest rates and the Fed slowing its cycle of cuts, has led to a depreciation of the euro of around 7% between September 2024 and January 2025. We expect this depreciation to continue to some extent, with the euro losing around 5% of its value against the dollar on average in 2025 compared with 2024. Thus, despite the fall in the dollar, the euro price of Brent would remain unchanged at €74 per barrel.

With regard to activity in foreign markets, we have lowered the expected growth of the euro area in 2025 by 0.5 p.p. to 0.8%, mainly due to the weakness of the German economy and in view of the new tariff policy promoted by the Trump administration. This slightly less favourable scenario reinforces the narrative that Spanish export growth will slow in 2025.

Outlook

The good growth figures in the last part of 2024 lead us to revise upwards the GDP growth forecast for 2025. However, the increased likelihood of tariff tensions between the US and the EU calls for caution. We therefore forecast that the economy will grow by 2.5% in 2025, up from our previous forecast of 2.3% but slightly lower than the revision we could have made without this uncertainty factor.

Specifically, our scenario is based on a situation of "contained" tariff tensions, in which there is no escalation and, by mid-year, the uncertainty surrounding this issue has dissipated and the new "rules of the game" are already in place. This scenario entails a limited and temporary direct impact on the Spanish economy, as the reduced commercial exposure to the US implies an estimated impact of 0.1 p.p. less in GDP growth for every 10 p.p. increase in tariffs, and limits the biggest source of risk, which is the indirect impact stemming from the increase in uncertainty.

Growth will be driven mainly by domestic demand. Despite the good figures for the progress of private consumption and investment in Q4 2024, both components still lag far behind the other components of GDP. Thus, while GDP in Q4 2024 will be 7.6% above its pre-pandemic level, private consumption will be 3.6% and investment just 2.5%. The recovery of private consumption in the post-pandemic period is even more sluggish if we take into account the population growth since 2022. Thus, real per capita consumption in Q4 2024 is still 0.4% below the pre-pandemic level in Q4 2019. Falling interest rates and gradually moderating inflation will support domestic demand growth. Investment will be boosted by investment efforts related to NGEU funds and the high household savings rate, 14.2% in Q3 2024 compared to an average of 7.3% in the period 2015-2019, also provides plenty of room for private consumption to grow.

Nonetheless, we expect growth to moderate compared to last year as some of the tailwinds that have benefited our economy in recent quarters lose strength. In particular, we highlight the normalisation of the growth rate of the tourism sector and some moderation in expected population inflows. Similarly, the continued weakness of the European economy, whose growth forecast for 2025 remains below 1%, and the possible increase in tariffs between the US and the EU will have a negative impact on our economy.

Following on from this, we expect the external sector to make a slightly negative contribution to growth in 2025, in contrast to the positive contributions of previous years. This negative contribution is explained by the slowdown in the growth rate of exports, closely linked to the normalisation of growth in the tourism sector and the weakness of our main export markets, and by the greater dynamism of imports, due to the strength of domestic demand.

Meanwhile, in 2025 we expect inflation to maintain a trajectory of gradual moderation, reaching 2.5% in 2025 after averaging 2.8% in 2024. This moderation will be accompanied by a gradual reduction in inflation in the services component and a more marked correction in inflation in the food component (from 3.6% in 2024 to 2.0% in 2025), in line with what has been observed in recent months. By contrast, the energy component will act in the opposite direction, driven by the impact that the normalisation of VAT on electricity tariffs in January 2025 will have on the year as a whole, as well as by the impact of the depreciation of the euro on oil prices, limiting the extent of the correction in headline inflation.

Finally, we expect the labour market to maintain a robust pace of employment growth, albeit somewhat slower than last year. More specifically, we expect employment to grow by 2.0% in 2025, after 2.2% in 2024. In contrast, after the strong rebound in the labour force in 2023, with annual growth of 2.1%, the pace of growth in the labour force eased slightly to 1.3% in 2024. We expect the labour force to continue to grow significantly (1.2%) in 2025, but at a slightly slower pace than last year. These assumptions concerning employment and labour force trends lead to an improvement in the unemployment rate, which will fall from 11.3% in 2024 to 10.7% in 2025.

As usual, the risks surrounding the scenario are numerous and significant. The main upside risks are related to faster-than-expected growth in consumption and investment if interest rate cuts accelerate or households withdraw more accumulated savings. The possibility of a ceasefire in Ukraine could also lead to a fall in energy prices. However, the primary risks remain skewed to the downside and are primarily geopolitical. At the international level, a greater than expected increase in trade tensions between the US and the EU could have a greater negative impact on trade flows and, therefore, on the growth of our economy and that of our trading partners. Likewise, the possibility of a further escalation of the conflict in the Middle East cannot be ruled out, which could lead to a sharp increase in oil prices. At the national level, it is important that the implementation of NGEU funds gains traction and supports the recovery of business investment.