Caixabank (Go to Home)

Caixabank (Go to Home)“In 2025, the health of the economy appears robust, but politics will be the main source of uncertainty”, according to the Perspectives of CaixaBank Private Banking

Economic and Political Perspectives 2025 - CaixaBank Private Banking.

Economic and Political Perspectives 2025 - CaixaBank Private Banking.

- In terms of investment, opportunities are detected in developed markets beyond the United States and in sectors related to infrastructure investment, clean energy, automation and robotics, electrification, and data as a key resource for artificial intelligence.

- More than 4,000 Private Banking clients have participated in the nearly 40 meetings held throughout Spain, where the political and financial outlook for the year has been reviewed, and the investment keys for the coming months have been analyzed.

2025 will be "The Year of Overlap" for CaixaBank Private Banking. A term that aims to unify the two contradictions that will mark the year: while the health of the global economy appears robust and without expected fragilities; politics will consolidate as the main source of uncertainty. This is one of the main conclusions of the new Perspectives report from CaixaBank Private Banking, which has been presented to more than 4,000 clients in meetings held throughout Spain during the month of February.

Presentation of the CaixaBank Private Banking Perspectives in Barcelona.

Robust Economy

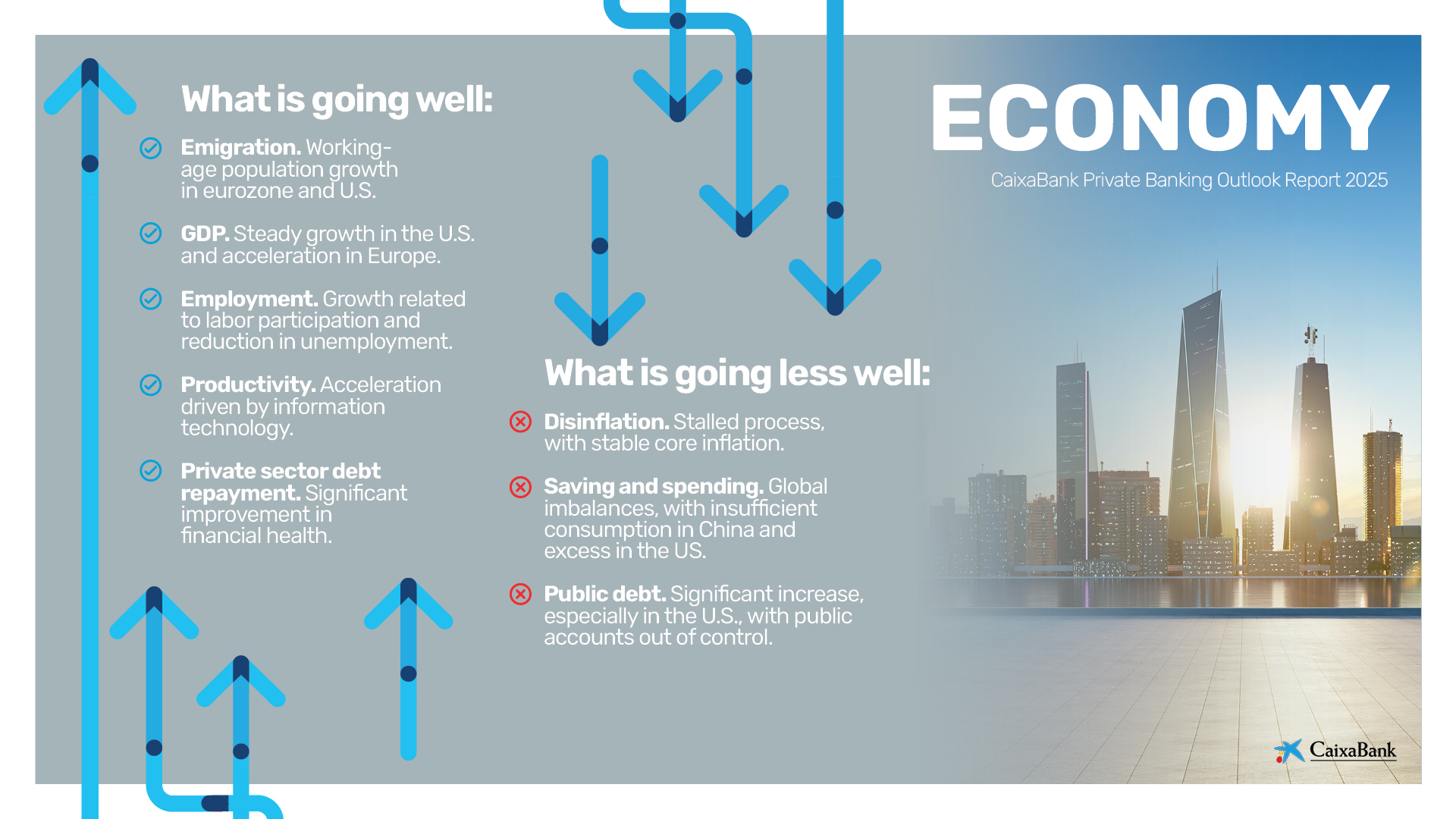

In the economic field, the report highlights that 2025 will mark the fifth year of an expansive cycle in which constant GDP growth is expected in the United States and an acceleration of growth in the eurozone. Job creation will also accelerate in territories with robust economies, with productivity improvement driven by information technologies. However, we face a significant increase in public debt, especially in the United States, with uncontrolled public accounts, as well as global imbalances in savings and spending.

Politics, Source of Uncertainty

As for politics, Europe will be immersed in profound institutional and economic change with the roadmap proposed by Mario Draghi, with elections in Germany and significant and positive transformations, while in the United States a period of uncertainty opens with the Trump administration, with possible deregulations, tax cuts, deportation of immigrants, and tariffs, and although this program is unlikely to be carried out except cosmetically, it does not diminish its ability to generate volatility.

Investment Trends

Regarding investment trends, fixed income will return to a principle of reality, with more realistic interest rates, while equities present an attractive average valuation, which could provide opportunities in developed markets beyond the United States, now with excesses that will be corrected sooner or later. In terms of investment, opportunities are detected in sectors related to infrastructure investment, clean energy, automation and robotics, electrification, and artificial intelligence, with data consolidated as a key resource in the global economy.

From CaixaBank Private Banking, they point out: "We are facing a complex year, although full of opportunities that will need to be seized. It will be important to keep a cool head and prioritize tact over emotions."

With these events, we provide our clients with the keys that will shape the economy and politics of the coming year, helping them in their investment and savings decisions. This demonstrates CaixaBank Private Banking"s commitment to being by their clients" side in their daily lives.

About CaixaBank Private Banking

CaixaBank's private banking model consists of a team of more than 1,100 accredited specialized managers, with an average experience of 15 years, and with 75 exclusive private banking centers and 11 exclusive Wealth centers, ensuring that clients always receive close treatment.

In 2024, CaixaBank was chosen for the second consecutive year as the 'Best Domestic Private Bank in Spain' in the Global Private Banking Awards by the British magazine Euromoney, which recognizes excellence and best practices in private banking at an international level. CaixaBank Private Banking has received Euromoney's highest national award six times in the last 10 years.

CaixaBank Private Banking's value proposition offers different service models to adapt to the needs and preferences of each client, from those who demand a global advisory service, whether independent or not, to those who operate on their own initiative in managing their wealth through a platform with global investment capabilities in securities, funds, savings insurance, and other management products.