Caixabank (Go to Home)

Caixabank (Go to Home)Supply chain finance: a path to sustainable growth

CaixaBank.

CaixaBank.

- By Andrea Lamadrid Iannaco – Responsible for ESG Advisory, Laura Prats Bru – Responsible for Institutional & Transactional Sustainable Finance; and Pablo Pérez-Montero – Global Head of Sustainable Finance & ESG Advisory; all of CaixaBank CIB

In this article, made in collaboration with the Loan Market Association (LMA), we explore the importance of sustainable supply chain management, put forward our proposal for establishing a market benchmark for sustainable supply chain finance (SSCF), and discuss the challenges and opportunities associated with this.

At a time when sustainability has become a cornerstone of corporate strategy, the focus on sustainability[1] principles within supply chain management is more critical than ever. The global push for greener practices is not only a response to rising regulatory demands but also reflects increasing corporate awareness about the broader benefits of a sustainable approach.

The International Context: A New Era of Accountability

As organisations worldwide acknowledge their responsibility beyond their own operations, the supply chain's role in sustainability has gained unprecedented attention. This holistic view recognises that sustainability extends across the entire length of the value chain, including small and medium-sized enterprises (SMEs), prompting companies to adopt sustainability-centric selection criteria for suppliers and develop purchasing policies that align with these values. The emergence of international regulatory frameworks such as the Corporate Sustainability Due Diligence Directive, Corporate Sustainability Reporting Directive, and the U.S. Securities and Exchange Commission's Climate Disclosure Rule, is a further reason for organisations to prioritise sustainability considerations. Compliance with these regulations nudge businesses towards more sustainable practices, fostering a global standard beyond borders and industries.

Benefits of Embedding Sustainable Finance Solutions in Supply Chain Management

Integrating sustainable finance solutions into supply chain management offers several compelling benefits.

- Better access to capital investment and capital allocation

Investors increasingly prioritise sustainability criteria when providing liquidity to the market, and are therefore drawn to organisations and projects able to demonstrate strong sustainability performance in their supply chains. This can result in more favourable financing terms and improved capital allocation towards sustainable projects.

- Enhanced risk management

Incorporating sustainability factors into financial analysis enhances risk management. By identifying potential sustainability-related risks, companies can proactively pre-empt issues that could disrupt operations and harm their reputations.

- Innovation

Sustainable finance drives investment in innovative technologies and solutions that enhance supply chain performance, including advancements in renewable energy, circular economy initiatives, waste reduction, and ethical sourcing. These innovations contribute to sustainability goals and position companies as industry leaders, sharpening their competitive edge.

- Stakeholder engagement

Financing initiatives focused on sustainable supply chain management foster collaboration and engagement among all stakeholders, including suppliers, customers, investors, and regulators. This multi-stakeholder approach fosters a more comprehensive and effective dialogue and knowledge sharing, resulting in meaningful and collective action to address sustainability challenges.

- Long-Term Value Creation

By integrating sustainability considerations into investment decisions, sustainable finance promotes long-term value creation for companies and investors. Adopting sustainable practices in the supply chain enhances resilience, competitiveness, and brand reputation. This contributes to better financial performance while laying a sustainable foundation for future growth.

Sustainable Supply Chain Finance

Despite its benefits, SSCF remains an emerging field.

Currently, the sustainable finance products on offer primarily fall into two categories: "Use of Proceeds" and "Sustainability-Linked" financing[1]. The former focuses on specific investments with positive environmental or social impacts, while the latter ties general financing to sustainability performance targets based on key performance indicators[2]. However, when we seek to adapt these structures for suppliers, we find different interpretations of application with no homogeneity in terms of structure, geography, and sector. This lack of universality of product offering has resulted in few companies implementing SSCF despite high levels of interest in the product.

It is therefore apparent that a standardised approach to SSCF is required. Such an approach should seek to (i) create clear criteria for evaluating sustainability performance of the suppliers; (ii) produce financing conditions for the most sustainable suppliers; and (iii) encourage sustainable development of the global supply chain, including amongst SMEs.

We have therefore created the following proposal to act as a market benchmark.

CaixaBank’s Proposal

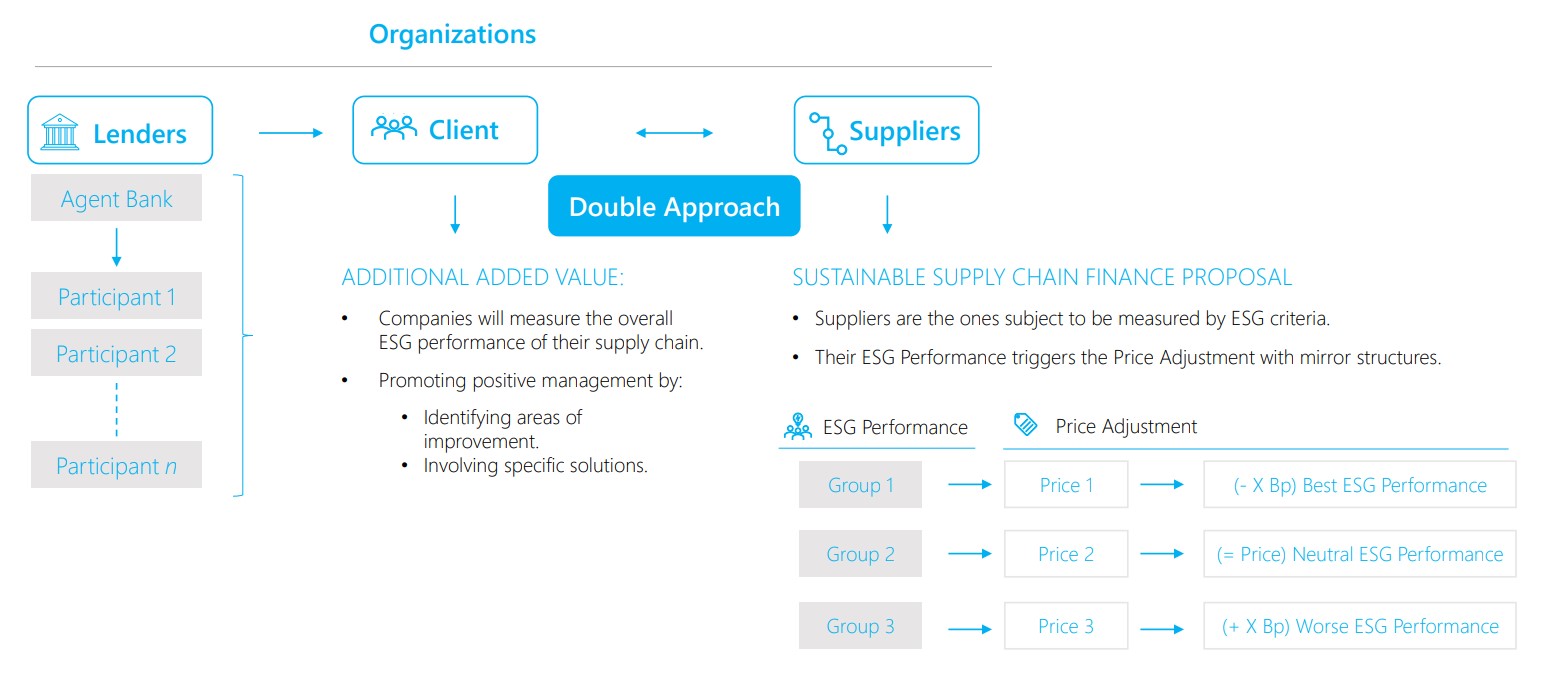

The above figure demonstrates the double focus on the client and suppliers, where the sustainability performance of each supplier involved is measured, providing a comprehensive view of the entire supply chain.

The incentive structure of traditional sustainability-linked loans is maintained, with the sustainability performance of the suppliers triggering a price adjustment (or other economic incentive). This approach would incentivise excellent performance (Group 1), while offering pathways for improvement to those falling behind (Groups 2 and 3).

It also enables the corporate and institutional clients to understand the global performance of their supply chain, detect areas for development and achieve a progressive improvement in the global sustainability performance of suppliers.

We therefore believe this model could significantly improve supply chain sustainability.

Challenges and Opportunities:

Implementing SSCF presents several challenges. Accurate, traceable data is essential to design scalable solutions that do not place SMEs at a disadvantage. It is therefore vital to raise awareness among all supply chain participants, particularly SMEs.

Financial institutions must also develop comprehensive solutions that allow the implementation of sustainability in practice, promote sustainability incentives and improve the management of the entire value chain.

Sean Edwards – Chairman of ITFA and Head of Legal at SMBC Bank International plc “It’s right to emphasise the value of high quality and verifiable data when looking at supply chains. That data will inform decisions not just on pricing, allocation and availability but on how accurately a lender can report its position to a regulator, a pressing need given the plethora of existing and new legislation. In ITFA, we have established what we are calling an Audit Council to look specifically at issues of data and common reporting standards matching the needs of banks and regulators but also setting a baseline for the type of data we need.”

Joana Capote Soares, Transactions and Sustainable Finance Iberia Director, Anthesis - The need for a clear framework of financial products classified under Sustainable Chain Supply Finance seems of the most elemental importance. It also seems of the utmost importance that these financial products withdraw as much as they can from the uniformization of standards that the regulatory framework (i.e. CSRD and CSDDD) will allow. Sustainable finance allows the entirety of the value chain to improve their sustainability performance through the aid of these instruments. Either through project-based financing such as green or social bonds, aligned with the green taxonomy and the soon-to-be social taxonomy, or through target-based projects such as sustainability-linked financing. But as with every sustainability reporting, voluntary or not, greenwashing is in the lurk, and if companies and financial institutions want to trigger real change across the value chain, sustainable supply chain finance instruments must clear, trustful, reasonable and, simultaneously demanding as well as financially enticing.

Despite these challenges, the opportunities are significant. Establishing universal benchmarks for SSCF can provide transparency and demonstrate alignment with international standards. This would enable clients to gain a holistic view of their supply chain, identify areas for improvement and drive collective progress towards sustainability goals. SSCF can enhance sustainability across the entire value chain, ultimately benefiting both businesses and the environment.

Conclusion

Integrating ESG principles into supply chain management through sustainable finance can transform corporate sustainability. By addressing both challenges and opportunities, businesses can harness the power of SSCF to foster a more sustainable, resilient, and competitive global economy.

[1] Incorporating environmental, social and governance (ESG).

[2] See green, social and sustainability-linked loan principles at https://www.lma.eu.com/sustainable-lending/resources.

[3] In SSCF transactions, the KPIs tend to be bespoke to the transaction at hand (rare due to market difficulties in obtaining homogenised data) or based on ESG rating/scoring from external vendors (at high cost to both the client and suppliers). In rare instances, they may align to a client’s internal methodology and internal scoring system, but these are often not verified and lack external validation.