Caixabank (Go to Home)

Caixabank (Go to Home)CaixaBank reports a net profit of €4.25 billion in the 9 months to September, up 16.1%, thanks to its growth in commercial activity and financial stability

The CEO of CaixaBank, Gonzalo Gortázar, during the press conference for the 9M24 results presentation.

The CEO of CaixaBank, Gonzalo Gortázar, during the press conference for the 9M24 results presentation.

- Gonzalo Gortázar, CaixaBank’s CEO, explains that "the third quarter has continued the positive trends seen in the first six months of the year: strong commercial activity, contained non-performing loans, solvency and liquidity well above requirements and a profitability that has reached satisfactory levels".

- The Board of Directors has approved the distribution of an interim dividend of €1.07 billion, which corresponds to a gross amount of 14.88 cents per share.

- The Bank's results demonstrate the strength and growth of the business. Customer funds increase 6.9% YtD and new loan production rises 20% YtD.

- Net subscriptions in mutual funds, savings insurance and pension plans totalled €8.78 billion in the first nine months of the year.

- Positive performance of new mortgage production (+55%), consumer credit (+15%) and companies (+14%) in the first nine months of the year.

- Improved P&L margins. Net interest income is up 13.6%, gross income is up 10.3% and operating income is up 14.5%.

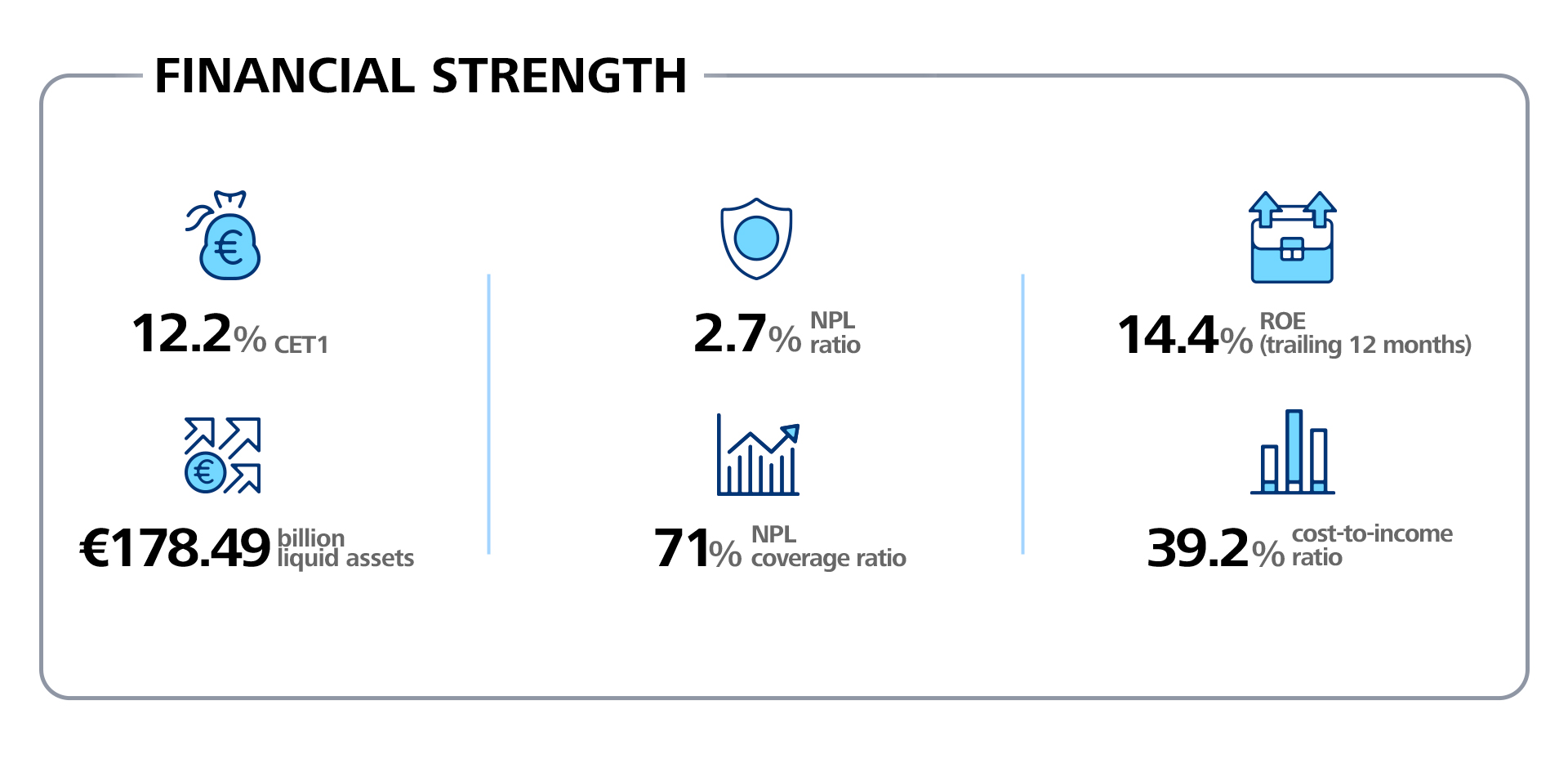

- Return on equity (ROE) stands at 14.4% and the cost-to-income ratio improves to 39.2%.

- The NPL ratio remains contained and at historically low levels, at 2.7%. The coverage ratio is 71%.

- The Group has a comfortable liquidity position and strong organic capital generation. Total liquid assets amount to €178.49 billion and the CET1 ratio stands at 12.2%.

- Continued support to the economy and society. CaixaBank's commitment to a different way of banking has been reinforced by expanding its presence across 3,244 municipalities in Spain through physical branches, ATMs or mobile branches.

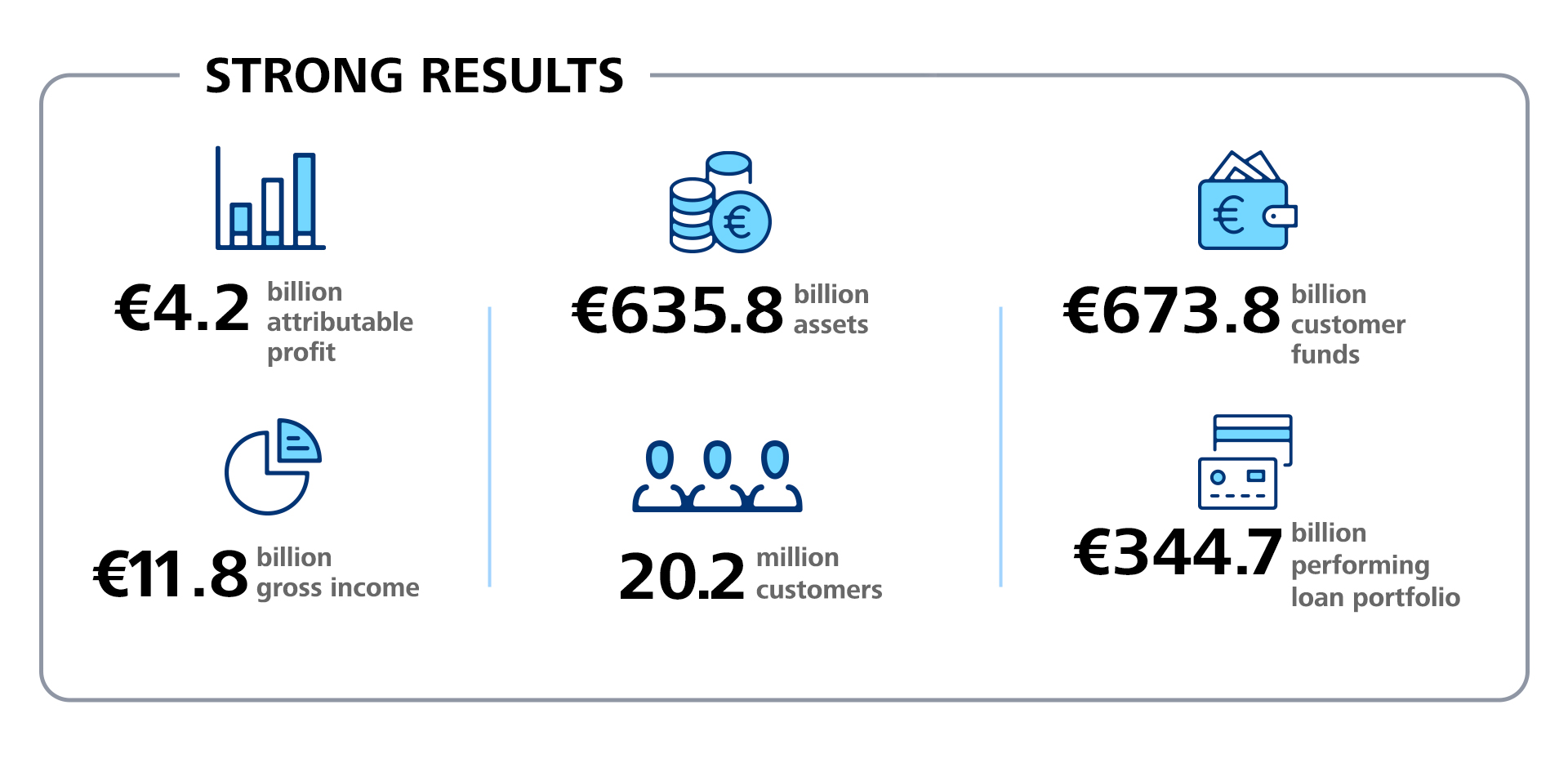

The CaixaBank Group reported a net attributable profit of €4.25 billion between January and September 2024, 16.1% more than in the same period of the previous year (€3.66 billion), thanks to strong growth in business activity and its high financial strength.

The Group, which serves 20.2 million customers through a network of more than 4,100 branches in Spain and Portugal, exceeds €635 billion in assets. The bank also consolidated its leadership in Spain and improved its market share, enabling it to play a key role in contributing to sustainable economic growth and financial inclusion.

The Bank's positive results, which reflect the stability and strength of its activity, also illustrate the success of the goals set out in the 2022-2024 Strategic Plan, which culminates at the end of this year and lays the best possible foundations for the development of the 2025-2027 Strategic Plan, which will be presented on November 19th.

CaixaBank's Chief Executive Officer, Gonzalo Gortázar, explained that "we have had a third quarter that has continued the positive trend seen in the first six months of the year: strong commercial activity, contained non-performing loans, solvency and liquidity well above requirements and profitability that has reached satisfactory levels".

"The improvement in activity, underpinned by a dynamic commercial environment, continues to support CaixaBank's position as a leading bank in Spain. Customer funds increased by €43.5 billion and new loan production continues to move forward at a very good pace, up 20% on the same period", he stated.

Strength of a business based on specialisation

The Bank's results between January and September reflect the strength of the business and the strong growth of CaixaBank's commercial efforts, which is developing a socially responsible universal banking model with a long-term vision. This model is based on quality, proximity, omni-channelling and specialisation, with professionals and branches differentiated for each customer segment.

Customer funds amounted to €673.83 billion at the end of September, 6.9% more than in December 2023 (€630.33 billion). On-balance sheet funds amounted to €487.17 billion, up 5.1%, thanks to the good performance of demand deposits (+2.5%), time deposits (+16.6%) and liabilities under insurance contracts (+6%). Assets under management increased 10.8% to €178.13 billion, with rises of 12.4% in mutual funds, portfolios and SICAVs, and 6.6% in pension plans.

Intense commercial efforts have been made in wealth management products so far this year. Net subscriptions of mutual funds, savings insurance and pension plans continued to grow at €8.78 billion between January and September, up 54.3% year-on-year from the €5.69 billion reached last year, enabling improvements in market shares in these products.

The performing loan portfolio amounted to €344.68 billion at the end of September, marking a 0.2% year-on-year increase, supported by strong performance in new lending across all segments.

New mortgage production amounted to €10.34 billion between January and September, 55% more year-on-year, and with nearly 75% of the total granted at a fixed rate. Of the entire mortgage portfolio, almost 40% is at a fixed rate, a formula that enables customers to know from the outset how much they will pay each month throughout the life of the loan without being subject to interest rate fluctuations.

In consumer credit, €9.02 billion were granted in the first nine months of the financial year, up 15%. In companies, new lending amounted to €31.55billion, up 14%. In the SME segment, a total of 124,633 operations were signed between January and September (+25%).

Net interest income reflected the improvement in business activity

Net interest income reached €8.37 billion in the first nine months of the year, which represents an increase of 13.6%, backed by the strong commercial activity and the current interest rate environment. On a quarter-on-quarter basis, net interest income remained virtually unchanged (+0.1%).

Revenues from services (wealth management, protection insurance and banking fees) increased 3.8% to €3.67 billion. Revenues from wealth management grew 12.4% because of higher volumes caused by the performance of the market and strong commercial activity. Revenues from protection insurance increased 6%, although banking fees fell 3.6% in the first nine months.

Growth in gross income is up 10.3% year-on-year (to €11.8 billion between January and September), outpacing the rise in recurring administrative expenses and depreciation (+4.5% to €4.56 billion), which helped operating profit to rise to €7.23 billion at the end of September (+14.5%).

The notable boost in business activity and rigorous risk management are reflected in all CaixaBank's income statement margins, with improvements in profitability and efficiency: the return on equity (ROE) was 14.4% at the end of September and the efficiency ratio was 39.2%.

Financial strength and contained NPLs

The CaixaBank Group continues to reinforce its financial strength, with an NPL ratio that remains contained and at historically low levels, a comfortable liquidity position and strong organic capital generation.

The non-performing loans balance fell for another quarter and accumulated a decrease of €164 million so far this year, standing at €10.35 billion at the end of September, thanks to active risk management. The NPL ratio remained at 2.7% and the coverage ratio stood at 71%. The cost of risk (last 12 months) stands at 0.28%.

CaixaBank also has a comfortable liquidity position, as total liquid assets have grown by €18.28 billion since December 2023, to €178.49 billion. The Liquidity Coverage Ratio (LCR) on 30 September was 213%, well above the minimum requirement of 100%.

The Group also has a solid level of capital, with the Common Equity Tier 1 (CET1) ratio at 12.2%, reflecting the impact of two share buyback programmes announced in March and July (€500 million each, down 44 bps in total) and the fifth program announced in October (€500 million, down 22 bps), all of which are part of the 2022-2024 Strategic Plan. In the first nine months of the year, the bank generated 172 bps of organic capital.

Compelling shareholder returns

In February last year, CaixaBank's Board of Directors agreed to a dividend plan for the 2024 financial year consisting of a cash distribution of between 50% and 60% of consolidated net profit, to be paid in two cash payments: an interim dividend to be paid during November 2024, amounting to between 30% and 40% of the consolidated net profit for the first half of 2024, and a final dividend to be paid in April 2025, subject to final approval by the General Shareholders' Meeting.

In accordance with this plan, the Board of Directors has approved the distribution of an interim dividend of 40% of the consolidated net profit for the first half of 2024, amounting to €1.07 billion (14.88 cents gross per share), payable in November.

CaixaBank has also announced a fifth share buyback programme for €500 million, which will begin sometime after November 19th. The programme will be announced in due course and will have a maximum duration of six months from its start date. The share buyback programmes announced as part of the 2022-2024 Strategic Plan total €3.8 billion.

With all these actions, the Group reaffirms its commitment to an attractive shareholder remuneration policy and to distribute €12 billion under the current Strategic Plan, of which it has already committed nearly €9.5 billion, including initiatives already carried out, ongoing and announced.

Continued support to the economy and society

CaixaBank's commitment to a different way of banking and its responsibility to provide ongoing support to families, companies and society in general was also reinforced in the period with initiatives relating to financial inclusion, solutions with a social impact, social projects in the region and a commitment to the environment.

In terms of promoting financial inclusion, the bank has a presence in 3,244 towns in Spain through either a physical branch, ATM or mobile branch, which means that it has started to provide a service to an additional 237 municipalities in the last twelve months. In addition, since the Euribor entered positive territory, there are some 49,300 beneficiaries of payment agreements for their loans, refinancing or solutions linked to the Code of Good Mortgage Practices. Meanwhile, social housing stock stands at more than 9,800 units.

In its commitment to sustainability and the environment, the bank has already achieved and surpassed the target set in the 2022–2024 Strategic Plan to mobilise €64 billion in sustainable finance, having reached a total of €74.65 billion by the end of September. On education, more than 7,300 students in the last year have benefited from the CaixaBank Dualiza programmes that promote dual vocational training.

Video CaixaBank's CEO, Gonzalo Gortázar

Quote from CaixaBank's CEO, Gonzalo Gortázar

Gonzalo Gortázar’s quotes (video) on banking tax

Gonzalo Gortázar’s quotes (video) on torrential floods in Spain

Gonzalo Gortázar’s quotes (video) on the resignation of chairman Goirigolzarri

Gonzalo Gortázar’s quotes (audio) on banking tax

Gonzalo Gortázar’s quotes (audio) on torrential floods in Spain

Gonzalo Gortázar’s quotes (audio) on the resignation of chairman Goirigolzarri