Caixabank (Go to Home)

Caixabank (Go to Home)CaixaBank reports a net profit of €3.66 billion in the 9 months to September, up 48.2%

CaixaBank's CEO, Gonzalo Gortázar in the presentation of third quarter results.

CaixaBank's CEO, Gonzalo Gortázar in the presentation of third quarter results.

- Financial strength and reasonable profitability will allow CaixaBank to offer an adequate return to its shareholders, with ”la Caixa” Foundation and the Spanish State through the FROB (Spanish Fund for Orderly Bank Restructuring) being the two most significant ones, to maintain its commitment to support individuals, families, businesses, and the wider economy, and to further advance its positive social impact.

- Gonzalo Gortazar, CEO of CaixaBank, highlights that “the bank’s performance in the first nine months of this year has been very positive. In the context of interest rate normalisation, our results are solid, a consequence of good commercial dynamics and prudent credit risk management.”

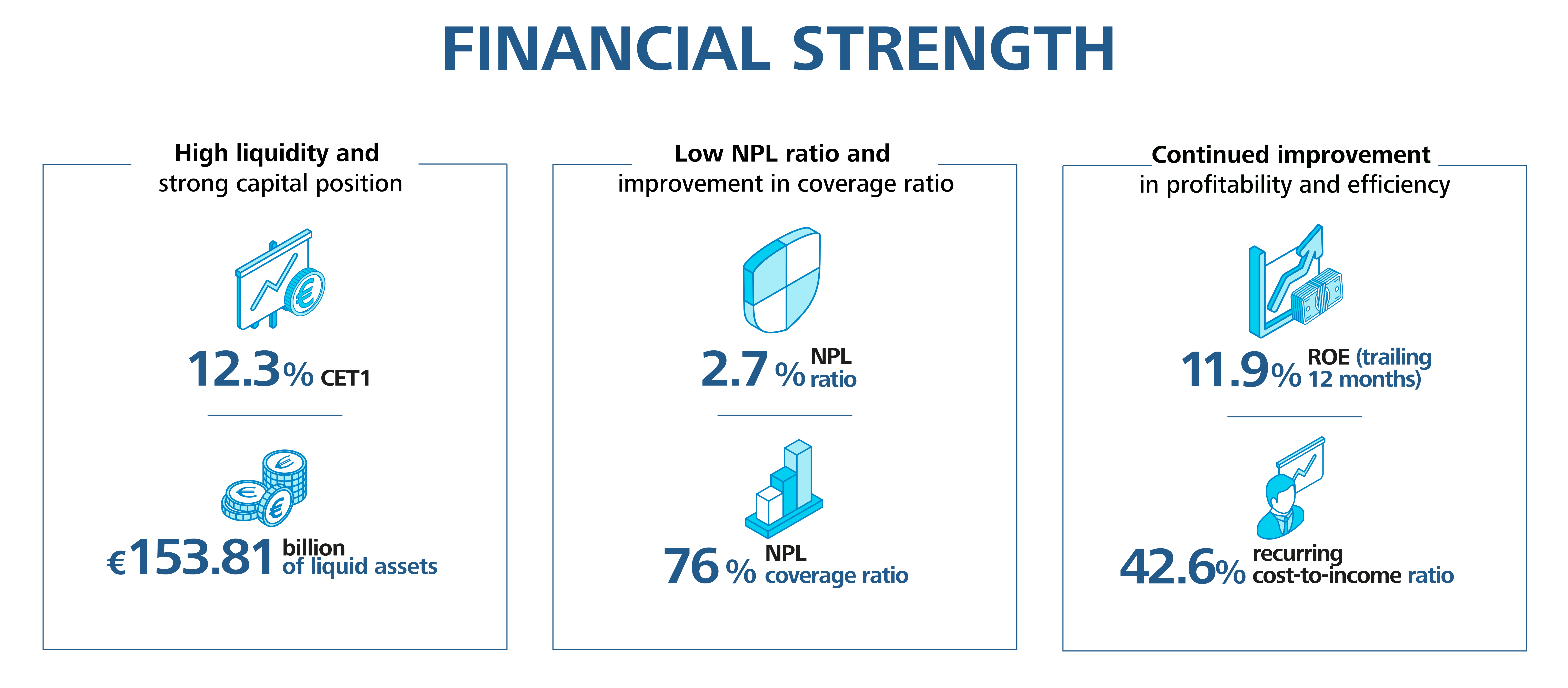

- Continued improvement in profitability and efficiency, with ROE reaching 11.9% and recurring cost-to-income ratio falling to 42.6%.

- Gross income is 28.9% higher than in the first nine months of 2022, underscoring the strength of the banking business.

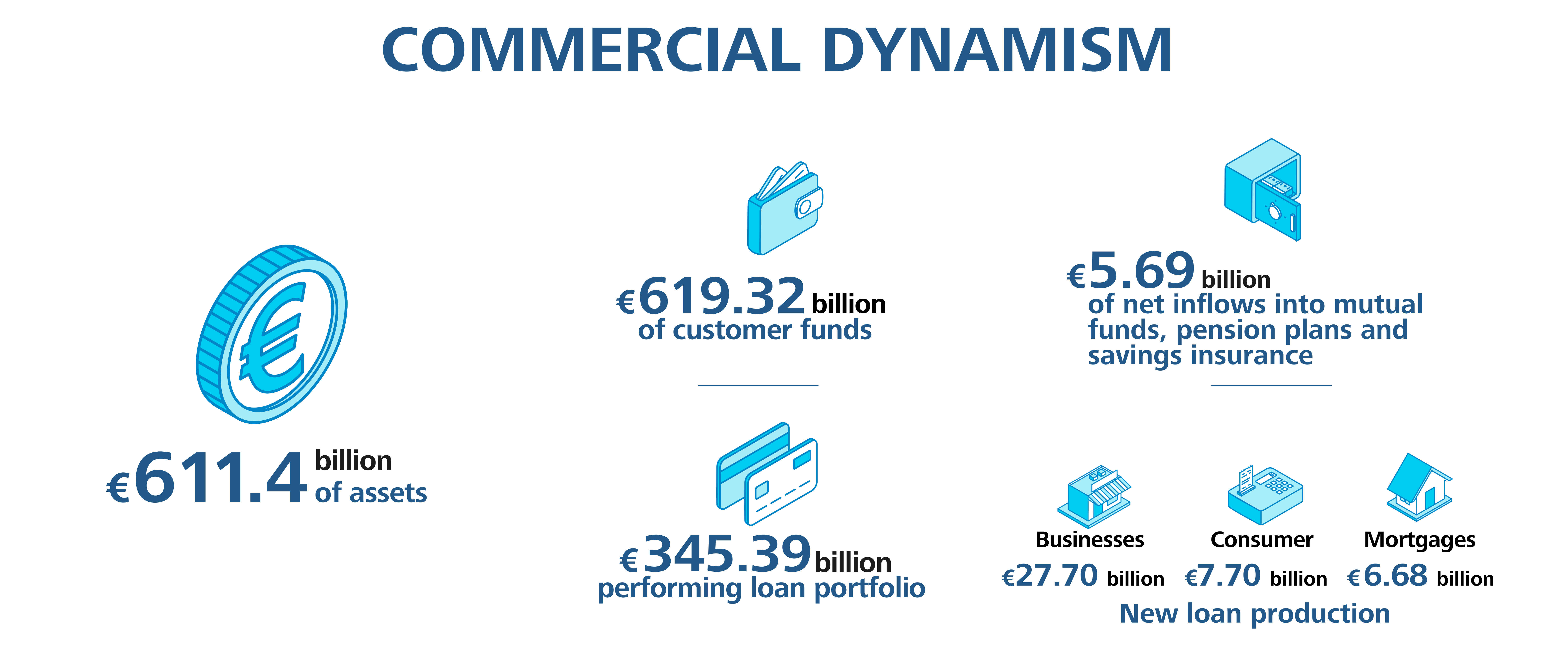

- Total business volume (including performing loans and customer funds) remain stable (+0.2% year-to-date). Customer funds at €619.32 billion (+1.3%) and the performing loan portfolio at €345.39 billion (-1.7%).

- Net inflows into mutual funds, pension plans and savings insurance stand at €5.69 billion, almost double the figure reported in the same period of 2022. In Spain, the combined market share of deposits and long-term savings improves to 26.4%.

- Growth in protection insurance, with new production up 5.4% year-on-year to €565 million in annualised premia.

- High liquidity and strong capital position. Total liquid assets amount to €153.81 billion, and the CET1 ratio at the end of the period stands at 12.3%.

- Active management of non-performing loans. The NPL ratio holds steady at 2.7%, with a reduction of €490 million in non-performing loans in the first nine months of the year. The coverage ratio rises to 76%, which is two points higher than in December 2022.

CaixaBank Group posted an attributable net profit of €3.66 billion for the first nine months of 2023, up 48.2% on the €2.47 billion reported in the same period of 2022.

CaixaBank CEO, Gonzalo Gortazar, highlighted that “CaixaBank’s performance in the first nine months of this year has been very positive. In the context of interest rate normalisation, our results are solid, a consequence of good commercial dynamics and prudent credit risk management”.

“We have the best bancassurance offering in the Spanish market, with customised solutions available for every client. In the past nine months, both customer funds and assets under management have grown by a combined €8 billion, and our insurance business has performed particularly well”, he added.

Gortazar also remarked that “this result allows us to improve our return on equity after several years of fairly low returns. This is, without doubt, very good news for our more than 600,000 shareholders and, in particular, for the “la Caixa” Foundation and the FROB, the Spanish Fund for Orderly Bank Restructuring, which will receive larger dividends. And above all, it will allow us to keep supporting our clients - businesses, individuals and families -, and society as a whole”.

Positive performance of the income statement

In the first nine months of the year, core revenues were up 34.3% year-on-year to €11.13 billion, driven by net interest income, which stood at €7.36 billion, up 60.7% on the same period of 2022. The growth in NII, compounded by the improvement in insurance service result (+21.2%) and equity accounted income from bancassurance stakes (+47.6%), offset the 5.3% decline in net fees. Specifically, recurring banking fees dropped by 9.1% year-on-year, mainly impacted by the end of cash custody fees on corporate deposits and the discounts applied under customer loyalty programmes.

As a result, gross income came to €10.69 billion as of 30th September, up 28.9% on the same period in the previous year.

The positive performance of the net income allowed the Group to report a return on equity (ROE) of 11.9%. Furthermore, the recurrent cost-to-income ratio (excluding extraordinary expenses) improved once again in the period, falling to 42.6%.

Stable customer funds and lending

In the first nine months of the year, CaixaBank maintained high levels of commercial activity and managed to increase the number of retail customers that use the bank for multiple products and services, a key objective in the bank’s strategy. Notably, CaixaBank increased its percentage of relational retail customers to 71.4% at the end of September, compared to 70.4% in December 2022.

Total business volume -including performing loans plus customer funds - remained stable (+0.2% in the year-to-date). Customer funds amounted to €619.32 billion as of 30th September, up 1.3% in the year-to-date, underpinned by sales of long-term savings products. In this context, assets under management totalled €155.26 billion (+5% in the year), on the back of net positive inflows in mutual funds and managed portfolios.

From January to September, net inflows in long-term savings products (mutual funds, pension plans and savings insurance) amounted to €5.69 billion, almost double the figure recorded in the same period of 2022 (€2.95 billion). As a result, the combined market share of deposits and long-term savings in Spain rose to 26.4%, thanks to a differentiated advisory model that accompanies customers throughout the whole savings and investment management cycle.

The bank also reported further growth in protection insurance, with new production up 5.4% year-on-year to reach €565 million in annualised premia.

In terms of customer funding, the performing loans portfolio amounted to €345.39 billion, revealing a small decline of 1.7% year-to-date, following the general trend observed at the sector level. Growth in business and consumer loans offset the decline in the mortgage loan portfolio, which was down 3.9% year-to-date, reflecting repayments compounded by lower production year-on-year, in a context of higher interest rates.

Specifically, between January and September 2023 new mortgage production totalled €6.7 billion, consumer loans came to €7.7 billion and business lending stood at €27.7 billion.

Low NPL ratio through active and prudent risk management

The NPL ratio was 2.7%, holding steady year-to-date, thanks to active and prudent risk management. Non-performing loans fell by €490 million in the year to reach €10.2 billion, following the strong performance of asset quality indicators.

The Group also has a robust coverage ratio, which increased to 76% in the period (74% at the end of 2022), while the cost of risk (trailing 12 months) was 0.3%. Meanwhile, total provision funds for insolvency risk were €7.73 billion, of which nearly €1.1 billion correspond to unassigned collective provisions, as of 30th September.

Strong liquidity and capital position

CaixaBank continues to report high levels of both liquidity and capital. Total liquid assets amounted to €153.81 billion as of 30th September, up €14.8 billion in the year. Meanwhile, the Group's Liquidity Coverage Ratio (LCR) was 205% as of 30th September, underscoring a comfortable liquidity position well above the minimum requirement of 100%.

In terms of capital, the Common Equity Tier 1 (CET1) ratio stands at 12.3%, well above regulatory requirements. This result follows the extraordinary impact after the first-time application of IFRS 17 (-20 basis points) and the full deduction of the maximum authorised amount of €500 million for the new share buyback programme launched in September (-23 basis points). Strong organic capital generation in the first nine months of the year stands out (+162 basis points).

Positive social impact

Financial strength and reasonable profitability will enable CaixaBank to offer an adequate return to its shareholders, with ”la Caixa” Foundation and the Spanish State through the FROB (Spanish Fund for Orderly Bank Restructuring) being the two most significant ones, to maintain its commitment to support individuals, families, businesses, and the wider economy, and to further advance its positive social impact.

CaixaBank has granted more than 250,000 financing transactions year-to-date and is managing around 6,000 applications to adhere to the Spanish Code of Good Practice for Mortgages. Moreover, since interest rates began to rise, it has helped close to 10,600 retail clients to restructure their debts to help them remain on a more sustainable financial footing and has converted 9,800 mortgages from floating to fixed rate.

The bank has almost 11,000 social housing units and around 360,000 customers with social or basic accounts. CaixaBank is firmly committed to financial inclusion, boasting a presence in more than 2,200 towns and cities across Spain, while being the only bank with a presence in 483 municipalities. It also serves an additional 675 communities with its mobile branches. As a further demonstration of its commitment to providing personal and quality client service, CaixaBank has 1,619 specialised managers focused on the needs of senior citizens.

Through MicroBank, CaixaBank’s social bank and a European leader in microfinancing, more than 100,000 microloans were granted between January and September 2023. Since its inception more than 15 years ago, MicroBank has facilitated the creation of 317,383 jobs thanks to the financial support it has provided to businesses and self-employed individuals.

Benchmark in sustainability

CaixaBank is firmly committed to becoming a benchmark in sustainability within Europe. It is the only Spanish bank to have voluntarily undergone (“solicited”) an ESG assessment by Sustainable Fitch, which equates to a firmer commitment towards reporting and enables a more in-depth analysis. Sustainable Fitch awarded CaixaBank an ESG Entity Rating of 2, one of the highest ratings in the financial sector worldwide.

CaixaBank, as a benchmark financial institution for businesses, has launched a plan to promote the green transition of companies looking to implement sustainability into their businesses. This pioneering project within the industry will help the bank's corporate customers tackle key processes and challenges such as decarbonisation and environmental improvement. The aim is to offer a personalised advisory service with the support and guidance of an expert team. With this in mind, the bank has trained 150 specialist managers to help advise clients on the opportunities offered by sustainability as a driving force in their businesses.

Video CaixaBank's CEO, Gonzalo Gortázar