Caixabank (Go to Home)

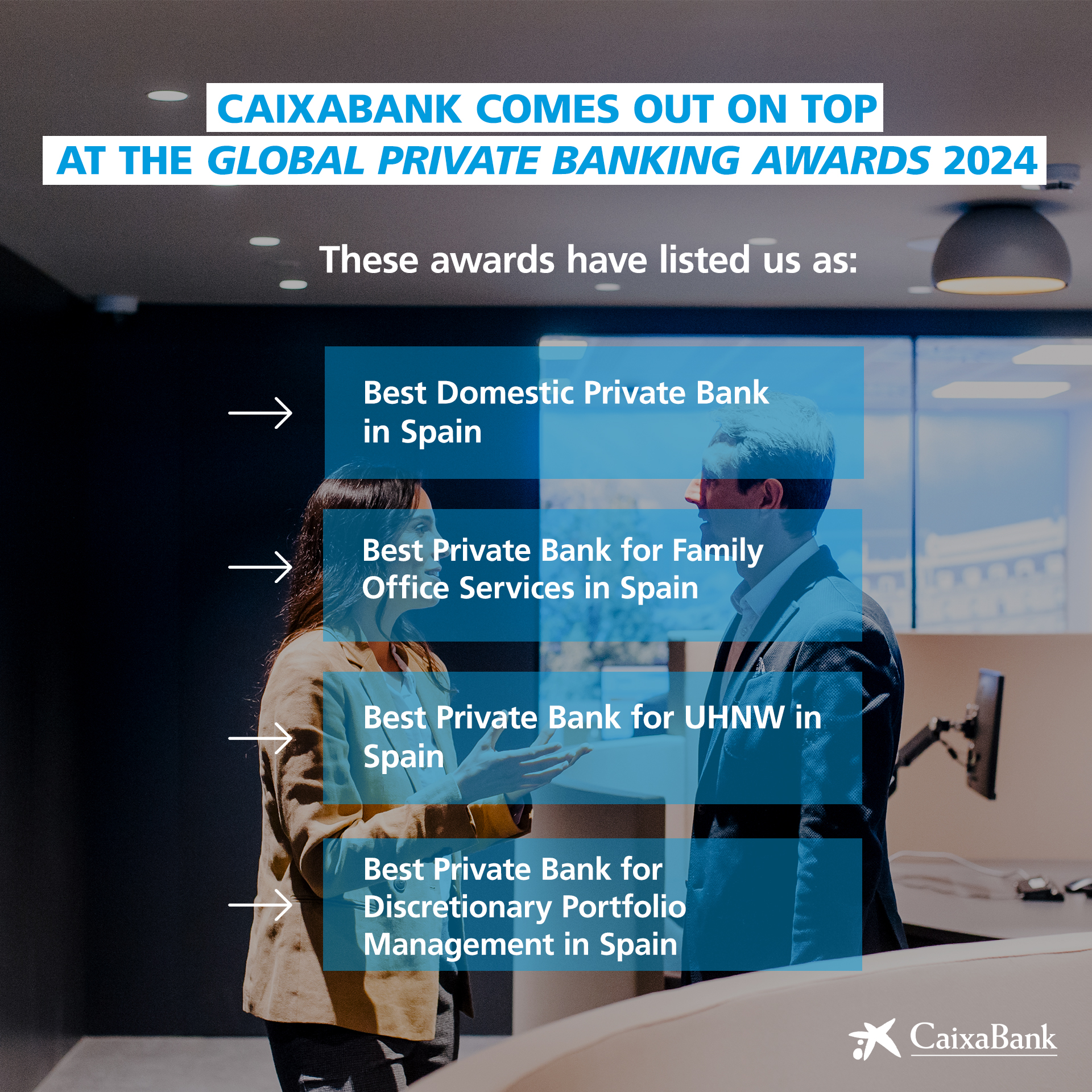

Caixabank (Go to Home)CaixaBank once again named 'Best Domestic Private Bank in Spain' by Euromoney

CaixaBank office.

CaixaBank office.

New international recognition for the bank's Private Banking business

- CaixaBank Private Banking has received Euromoney’s top national award six times in the last 10 years

- Three more awards have been added to this national recognition: 'Best Private Bank for UHNW in Spain', 'Best Private Bank for Discretionary Portfolio Management in Spain' and 'Best Private Bank for Family Office Services in Spain'

- These international awards are the result of the success of a private banking model based on advising and accompanying customers through a wide range of exclusive and innovative products and services to meet their needs at all times

For the second year running, CaixaBank has been chosen as the 'Best Domestic Private Bank in Spain' in a new edition of the Global Private Banking Awards of the British magazine Euromoney, which recognise excellence and best practices in international private banking. CaixaBank Private Banking has received Euromoney's top national award six times in the last 10 years.

In addition to the national award, CaixaBank Private Banking picked up three more awards at the gala held in London: 'Best Private Bank for UHNW in Spain 2024' (ultra-high net worth), 'Best Private Bank for Discretionary Portfolio Management in Spain 2024' and 'Best Private Bank for Family Office Services in Spain 2024'. BPI, a CaixaBank subsidiary, was named 'Best Domestic Private Bank in Portugal 2024'.

These awards cement CaixaBank Group's position as the leading private bank in the Iberian Peninsula and are the result of the success of a model based on advising and accompanying customers through a wide range of exclusive and innovative products and services to meet their needs at all times.

To Victor Allende, Director of Private Banking at CaixaBank, 'this award is the endorsement of a value proposition which adapts to each customer thanks to the development of innovative models, such as ‘Independent Advice’ and ‘multi-family office’. A Private Banking Network model that ensures the best quality customer service.'

Recognition for the commitment to discretionary management and independent advice

The award for 'Best Private Banking Institution in Discretionary Portfolio Management in Spain 2024' recognises CaixaBank Private Banking's leadership in this segment, for which the institution held €27.69 billion under management at the end of 2023, 12.2% more than the previous year, as well as a market share of nearly 40%.

This year, CaixaBank Private Banking has strengthened its product portfolio within this offering, including its ‘Smart Income Portfolios’, which invest in 13 underlying funds. This solution manages funds on a delegated basis and includes an annual payment through the redemption of fund units. Also in 2023, the bank launched the ‘Máster Renta Fija Portfolio’ for those seeking a strategy focused on fixed income. Finally, the SUV (Selección Única de Valores or Single Securities Selection) Portfolios are pioneering in Spain by allowing direct investment in equities.

The award for 'Best Private Bank in Spain for UHNW 2024' (ultra-high net worth) recognises CaixaBank's commitment to independent advice to high-net-worth individuals.

Six years ago, the bank created CaixaBank Wealth, a value proposition for customers with assets worth more than four million euros, which has 11 exclusive Wealth centres and in 2023 reached €22.79 billion in assets under management.

In 2022, CaixaBank Private Banking launched Independent Advisory, a service aimed at customers with between one and four million euros of potential assets, providing specialised managers in our private banking centres. The service closed the year with €14.14 billion under management, more than doubling its 2022 figure (€6,17 billion).

As for OpenWealth, it is a pioneering independent advisory service in Spain, intended for customers worth over 50 million. With OpenWealth, CaixaBank became the first bank in Spain to offer its UHNW customers a multi-family office service regardless of where the customer's wealth is deposited. At the end of 2023, OpenWealth was managing the assets of 26 customers for a total of more than € 5 billion. This model has also been recognised by Euromoney as the 'Best Private Bank for family office services in Spain 2024'.

Global recognition for CaixaBank's model

CaixaBank Private Banking's value proposition offers various service models in order to adapt to each customer's needs and preferences. This ranges from those who demand a global advisory service to those who independently operate the management of their assets using a platform with global capabilities for investment in securities, funds, and other management products.

CaixaBank's Private Banking model is made up of a team of 1,096 specialised professionals with an average of 15 years' experience and 75 exclusive Private Banking centres and 11 Wealth centres that ensure customers always receive a personal and friendly service. At the end of 2023, the division had €136.18 billion in funds and securities under management, 16.7% more than in 2022.