Caixabank (Go to Home)

Caixabank (Go to Home)CaixaBank, the new bank of "la Caixa" Group, starts trading on the stock exchange

- The new bank is the tenth largest in the eurozone by stock market capitalisation and starts life with a core capital ratio of 11%, assets worth 265,479 million euros, 10.5 million clients and a leading position in most retail banking segments.

- The chairman of CaixaBank, Isidro Fainé, has declared that the "la Caixa" Group restructuring will mean the continuation of its current businesses, while allowing it to take advantage of any growth opportunities that may emerge and reinforce its welfare projects.

- The vice-chairman and CEO of CaixaBank, Juan María Nin, affirms that the restructuring "will not affect the Group's characteristic approach to banking, which has made it a leading operator in the Spanish financial sector".

CaixaBank will today be quoted on stock exchanges for the first time, following the successful restructuring of the "la Caixa" Group, which will now operate its financial businesses indirectly through the new bank. CaixaBank, the new name for Criteria CaixaCorp after it was transferred all "la Caixa" Group banking assets and converted into a bank, starts out life with assets worth 265,479 million euros, a core capital ratio of 11%1 and a leading position in most retail banking segments.

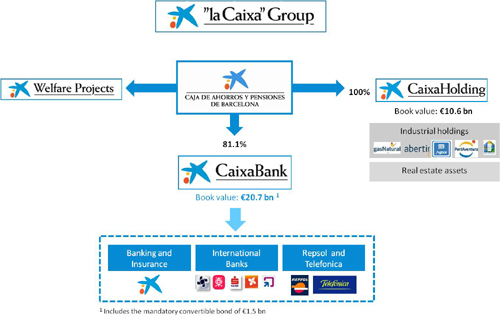

The Group restructuring sees Caja de Ahorros y Pensiones de Barcelona maintain its legal status as well as its founding values of leadership, trust and social commitment, and at the same time operate its financial activities via CaixaBank, in which it is the major shareholder. This reshaping will make for a stronger "la Caixa" Group, providing it with a more robust financial structure that will ensure future growth and long term value generation for all interest groups: primarily customers, employees and stakeholders.

The chairman of CaixaBank, Isidro Fainé, has declared that "the new structure will allow the Group to adapt to changing circumstances more quickly, while maintaining its current businesses, taking advantage of any growth opportunities that may emerge, providing access to the markets and also reinforcing our welfare projects, which have been strengthened and ensured". From now on, "la Caixa" Group's welfare projects will be funded using dividends received by Caja de Ahorros y Pensiones de Barcelona from its interests in CaixaBank and CaixaHolding.

The backing of 630,000 shareholders

The founding of CaixaBank was approved by the governing bodies of Criteria CaixaCorp and Caja de Ahorros y Pensiones de Barcelona, as well as sector regulators. The operation was preceded by a 1,500 million euros issue of subordinated bonds mandatorily convertible into CaixaBank shares. The issue will increase the number of CaixaBank shareholders from the current 365,000 to 630,000 once the bonds are converted.

The vice-chairman and CEO of CaixaBank, Juan María Nin, explains that the restructuring "will not affect the Group's characteristic approach to banking, which has made it a leading operator in the Spanish financial sector". "We will now enjoy all the benefits of remaining a savings bank as well as the instrumental advantages of holding bank status", adds Nin.

The branch and ATM networks, as well as our financial services, will continue to use the "la Caixa" brand in all relations with customers, who will now be customers of CaixaBank. This change will have no impact on branch services, with all products and services operating under the same coding and numbering system (CaixaBank will retain the 2100 bank code) and the same terms and conditions. Customers will be able to use the Línea Abierta' online banking service as normal, at www.lacaixa.es.

Restructuring of "la Caixa" group

The process of creating CaixaBank began on 27 January 2011, with the announcement that the "la Caixa" Group would undergo restructuring. It was also announced that the banking business run by Caja de Ahorros y Pensiones de Barcelona, "la Caixa", would be transferred to Criteria CaixaCorp, now called CaixaBank, in exchange for its industrial holdings (Gas Natural Fenosa, Abertis, Aguas de Barcelona, Port Aventura and Mediterránea Beach & Golf), which are now held under CaixaHolding, a new company controlled by Caja de Ahorros y Pensiones de Barcelona.

Financial interests, the insurance business and other industrial holdings (Telefónica and Repsol) are held by the new CaixaBank, with book value of 20.7 billion euros. "la Caixa" is the majority shareholder of CaixaBank, controlling approximately 81.1% of its capital and leaving similar free float levels as prior to the operation.

CaixaBank starts life with 5,277 branches, the largest network in the Spanish banking sector, 10.5 million clients, an NPL ratio of 3.95% with coverage of 65% and total banking turnover of 429,947 million euros, according to data released on 31 March 2011. The bank starts out with a core capital ratio of 11%1 and liquidity of 19,572 million, representing 7.4% of assets.

(1) Core capital figure as at 31 March 2011, including 1.5 bn in bonds mandatorily convertible into shares and the sale of 50% of the non-life insurance business.