Caixabank (Go to Home)

Caixabank (Go to Home)CaixaBank reports a net profit of €2.68 billion up to June (+25.2%), driven by a significant improvement in activity

Gonzalo Gortázar, CaixaBank's CEO, during the 1H earnings conference.

Gonzalo Gortázar, CaixaBank's CEO, during the 1H earnings conference.

- Gonzalo Gortazar, CaixaBank’s CEO, highlights that “the first half of the year has been very positive for CaixaBank across all business lines, enabling us to continue supporting the economy and society, and to strengthen our commitment to our differential banking model.”

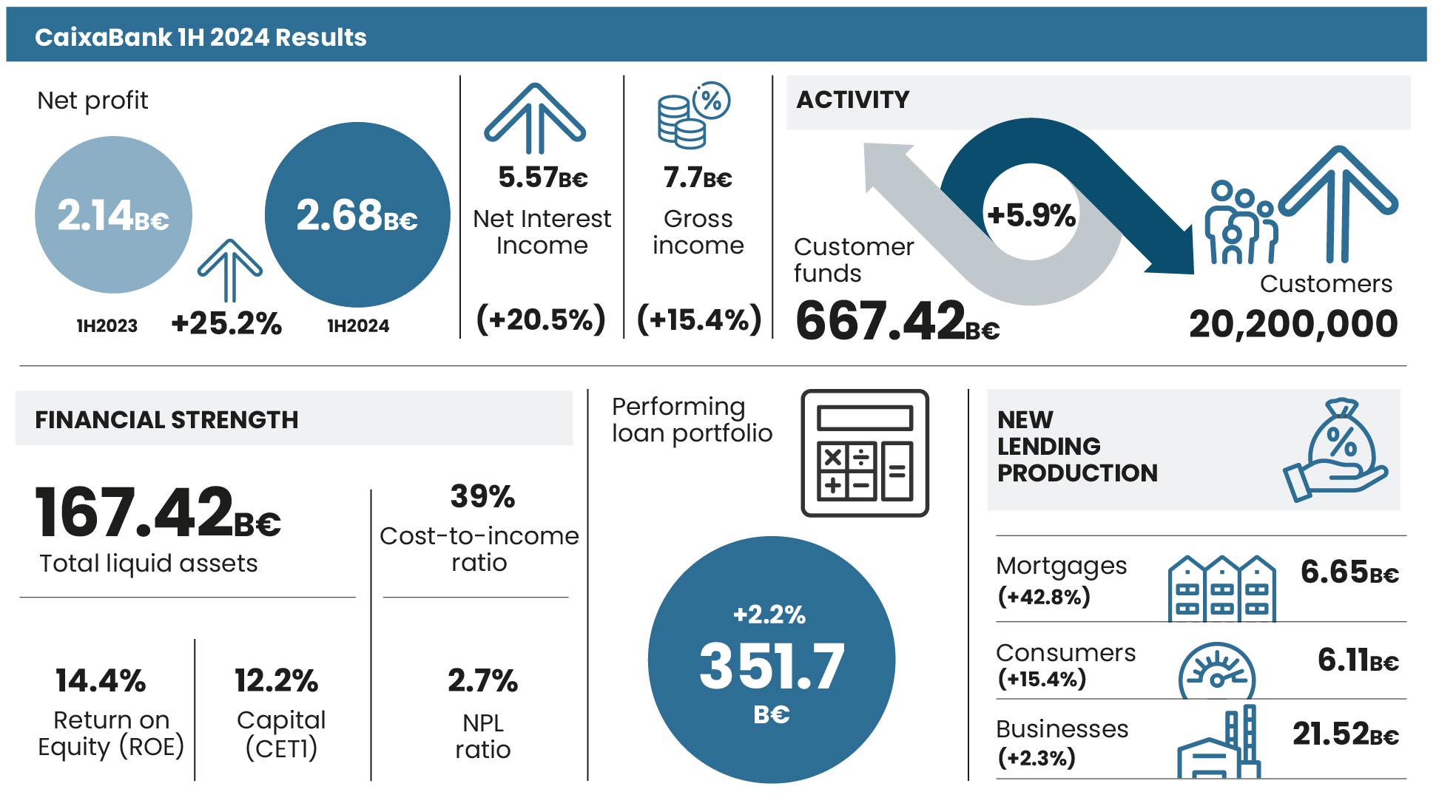

- Positive evolution of business volume, in a semester in which customer funds grow by almost +6%, to €667.42 billion, while the performing loan book increases by +2.2% to €351.70 billion.

- Good performance in new loan production, especially in residential mortgages, which increase by +42.8% compared to the first half of 2023, reaching €6.65 billion. Consumer loans grow by +15.4% to €6.11 billion, while loans to businesses rise by +2.3% to reach €21.52 billion.

- Intense commercial activity. Net inflows into mutual funds, savings insurance, and pension plans reach €6.42 billion between January and June.

- CaixaBank Group expands its customer base and now serves 20.2 million customers in Spain and Portugal, through a network of over 4,100 branches.

- Improvement in all P&L margins. Net interest income increases by +20.5% in the first half of the year and gross income by +15.4%.

- The strong activity performance allows the return on equity (ROE) to reach 14.4% and the cost-to-income ratio to improve to 39%.

- CaixaBank's financial strength is reflected in its comfortable liquidity and capital position, with €167.42 billion in liquid assets and a CET1 capital ratio of 12.2%.

- The Group maintains an active and prudent risk management policy, with an NPL ratio of 2.7% and a coverage ratio of 70%.

- Commitment to society. Financial inclusion remains a priority for the bank, which is present in 3,149 Spanish municipalities and has 382,000 customers with social or basic accounts.

CaixaBank Group reported an attributable net profit of €2.68 billion in the first half of 2024, up +25.2% from the €2.14 billion posted in the same period of 2023, bolstered by a significant improvement in activity, with growth in both lending and customer funds.

In this context, CaixaBank Group expands its customer base and now serves 20.2 million customers across Spain and Portugal, through a network of over 4,100 branches.

Gonzalo Gortazar, CaixaBank's CEO, noted that “the first half of the year has been very positive for CaixaBank across all business lines, enabling us to continue supporting the economy and society, and to strengthen our commitment to our differential banking model.”

Additionally, Gortazar highlighted that “the increase in business activity is the most encouraging trend of the last six months: customer funds have increased by €37.10 billion and the performing loan portfolio by €7.65 billion. This growth of almost €45 billion in the first half of the year has led us to continue improving our market shares and to strengthen our leadership in the banking sector.”

Growth in customer funds and lending

CaixaBank’s commitment to customer service and to its unique omnichannel and multiproduct distribution platform, which constantly evolve to anticipate customer needs and preferences, is reflected in the positive evolution of business volumes.

Regarding customer funds, they closed June at €667.42 billion, up +5.9% compared to December 2023, affected by the usual positive seasonality of demand deposits in the second quarter. On-balance sheet funds increased by +5.3% to €487.81 billion, with growth in demand deposits, term deposits and insurance funds; and assets under management amounted to €172.59 billion (+7.3%).

Once again, the good performance of net inflows into mutual funds, savings insurance and pension plans stands out, reaching €6.42 billion in the first half of the year, up +25.9% compared to the same period in 2023. When it comes to protection insurance, total premia were up +10.9% year-on-year.

On the lending side, the performing loan book increased by +2.2% compared to December 2023, to reach €351.70 billion (€7.65 billion more), with new production advancing at a very good pace.

Thus, in the case of mortgages, the performing loan portfolio stopped declining in the second quarter of the year, mainly thanks to the recovery of new production during the year, although it still shows a decline of -0.4% for the first half of the year. Meanwhile, the consumer loan portfolio grew up by +4.4% in the first six months of the year and the business loan portfolio grew by +2.3%.

Positive new production dynamics across all segments in the first six months of the year. In the case of residential mortgages, new production was up +42.8% compared to the first six months of last year, reaching €6.65 billion. Of the total granted in mortgages, circa two thirds were fixed-rate loans, a formula that allows customers to know from the beginning how much they will pay each month throughout the life of the loan without being subject to interest rate fluctuations.

In consumer lending, a total of €6.11 billion was granted between January and June, up +15.4% compared to the same period last year. Meanwhile, lending to businesses amounted to €21.52 billion (+2.3%), with more than 89,000 loans granted to SMEs in the first half of the year (+28% year-on-year).

Positive evolution of all profit margins

Between January and June 2024, CaixaBank's income statement reflects the improvement in activity, in a context of economic dynamism and stabilisation of interest rates, with an intense commercial activity, allowing the return on equity (ROE) to increase to 14.4% at the end of a semester in which the cost-to-income ratio also improved further to 39%.

Net interest income stood at €5.57 billion in the first half of the year, up +20.5% year-on-year, and revenues from services (wealth management, protection insurance and banking fees) grew by +4.4% up to €2.45 billion. Specifically, revenues from wealth management (+12.7%) benefitted from higher volumes coupled with intense commercial activity, and protection insurance revenues also increased (+11.2%), while banking fees decreased by -4.9% in the first half of the year.

Meanwhile, gross income grew by +15.4% (to €7.70 billion), exceeding the growth in recurring administrative, depreciation and amortisation expenses (+4.6%; €3.03 billion), allowing pre-impairment income to grow by +23.8% (to €4.67 billion).

Financial strength, prudent risk management, and ample liquidity

CaixaBank Group remained financially strong for yet another quarter, with an improvement in credit quality, active and prudent risk management, a reduction in non-performing loans and optimal levels of liquidity and capital, allowing it to fulfil its commitment to support families and businesses.

In risk management, the balance of non-performing loans slightly decreased in the semester to €10.47 billion, while the NPL ratio stands at 2.7%, in line with the December figure. Provisions for insolvency risk (€7.30 billion) yield a coverage ratio of 70%. The cost of risk trailing twelve months remains at 0.29% as it was at the end of the first quarter.

Another strength of CaixaBank is its ample liquidity position, with total liquid assets growing by €7.22 billion in six months to €167.42 billion, and a Liquidity Coverage Ratio (LCR) of 218% as of 30 June, more than double the required regulatory minimum of 100%.

This is coupled with a solid capital position. At the end of June, the Common Equity Tier 1 (CET1) ratio stands at 12.2%, after accounting for the extraordinary impact of the third share buyback programme completed in May for a total of €500 million (-22 bps) and the fourth programme announced in July for another €500 million (-22 bps), both part of the 2022–2024 Strategic Plan. Between January and June, CaixaBank has managed to organically generate 101 basis points of capital, while the dividend forecast for the year (60% payout) and the payment of the AT1 coupon have reduced it by 75 bps.

Strengthened commitment to society, families, and businesses

The positive results of CaixaBank Group in the first half of the year, combined with its financial strength, have allowed it to step up its commitment to a different way of banking and to supporting families and businesses. Moreover, half of the dividends distributed by the bank are returned to society through the ”la Caixa” Foundation and the FROB, Spain’s Executive Resolution Authority.

In this regard, the Board of Directors approved the dividend plan for 2024 last February, which consists of a cash payout of between 50% and 60% of the consolidated net profit, to be paid in two cash instalments: an interim dividend to be paid in November, amounting to between 30% and 40% of the consolidated net profit for the first half of this year, and a final dividend to be paid in April 2025, subject to final approval at the General Shareholders' Meeting. Based on the results of the first half of 2024 and the payout target for the interim dividend, the minimum amount to be distributed for this concept would be around €800 million. The relevant resolution by the Board of Directors and the final amount of this interim dividend will be defined in October.

Financial inclusion remains a priority for the Group, which is present in 3,149 Spanish municipalities through its network of traditional branches, mobile branches (ofimóviles), and ATMs and which has 382,000 customers with social or basic accounts.

CaixaBank is also firmly committed to promoting solutions with a positive social impact. Since the interest rate hikes began, around 46,000 customers in financial difficulties have benefited from payment agreements, refinancing arrangements or the measures included in the Code of Good Practices for mortgage holders. Additionally, the bank has around 10,000 social housing units.

Furthermore, nearly 16,600 volunteers from all across Spain participated in May in the second edition of CaixaBank's ‘Social Month’, an initiative aimed at promoting and encouraging volunteerism among the entity’s employees and their families, clients, and society in general, with a focus on companionship, education, the environment, digitalisation, culture and sport.

In the field of education, more than 7,300 students have benefited in the last 12 months from CaixaBank Dualiza programmes to promote dual vocational training; and in its commitment to the environment, the bank has already achieved and surpassed the target set in the 2022–2024 Strategic Plan to mobilise €64 billion in sustainable finance, having reached a total of €67.16 billion by the end of June.

Video CaixaBank's CEO, Gonzalo Gortázar