We are the leading financial group in the Spanish market, comprised of banking business, insurance activity and investments in international banks and leading companies in the services sector.

The CaixaBank Group, with Jordi Gual as Chairman and Gonzalo Gortázar as CEO, reported a net attributable profit of €90 million in the first quarter of the year, down 83.2% year-on-year in response to credit risk provisioning, which includes an extraordinary provision of €400 million as a prudent measure to deal with the impact that COVID-19 might have on the Bank's future results. Due to the impact of the pandemic, the Bank has suspended the financial targets envisioned for 2021.From day one of the state of alarm, the Bank has been working at full capacity as an essential supplier of services. Roughly 90% of the CaixaBank branch network has remained open since 16 March.

Improving customer experience

Accelerate digital transformation

Promote a collaborative and agile culture

Generate attractive returns for shareholders

Apply mechanisms for revenue growth:

Be a leader in responsible management

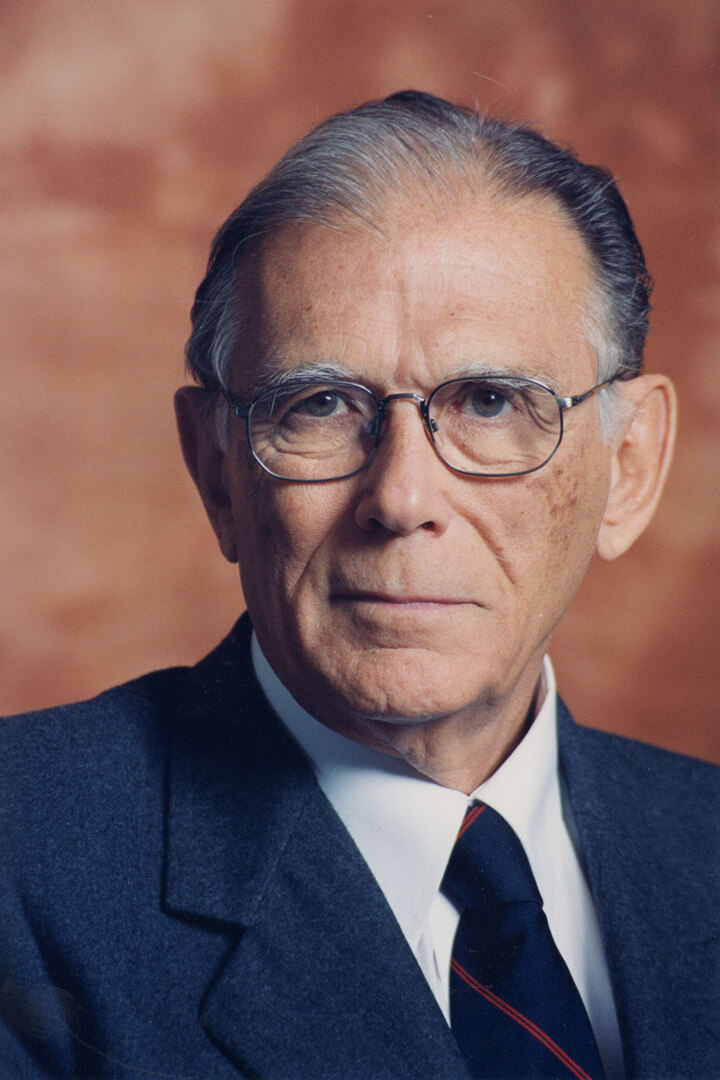

In the early 20th century, Francesc Moragas founded the Caja de Pensiones para la Vejez (Old Age Pension Society), supported by different organisations from Catalan civil society.Its aim was to stimulate savings and provide for the future.

Nowadays, it might seem to be a merely financial initiative but back in that unstable historical context, in the midst of a severe social crisis, it was a pioneering initiative to help less fortunate people, thereby avoiding financial exclusion.

Moragas set up a private institution with a new economic and social concept of saving that was the national forerunner to social welfare, one of the pillars of the current welfare state.

The Caja de Pensiones para la Vejez opens to the public backing proximity and ties with the region, by opening offices in the main towns in Catalonia.

Traits that have identified us over time: Proximity ,Closeness ,Social commitment, Business capacity, Outstanding management model, Promoting high quality service.

The organisation's Board of Directors agreed to start setting up the Caja de Pensiones para la Vejez y de Ahorros in the Balearic Islands.

Ever since it was founded, the organisation has backed a model of proximity and personal service wherever it was working. It currently has the largest network of offices in Spain with over 5,000 branches.

The bank holds the First Tribute to Old Age It is held as a sign of consideration and support for old people, a commitment that remains today and that saw the start of ”la Caixa” Foundation.

The Caja de Pensiones para la Vejez became the forerunning social welfare entity in Spain, promoting the first pension insurance for old age, a pioneering instrument at the time with a clear social purpose. Currently, the Group's pension administrator pays the most pensions in Spain after the Social Security system.

In addition, the first merger in the entity's history also took place in this year, in this case with the Caja de Ahorros del Empordà.

The first headquarters for the Caja de Pensiones para la Vejez y Ahorros was opened The building, designed by Enric Sagnier and located in Vía Laietana (Barcelona), was the bank's emblematic headquarters for many years.

The Foundation was included in the organisation Until then, bank surplus was sent to reserves and donations for charitable institutions but, from this year on, ”la Caixa” decided to include several institutions in its structure to ensure continuity and the quality of its services. In addition, a body was set up to manage and professionalise it: the Foundation (Obra Social).

Priority fields were established as health, equality and culture, adapting initiatives to the social needs at each point in time.

The first merger took place with a bank outside Catalonia.

This involved the Caja Rural para la Federación Católico-Agraria de Ibiza, actually the 15th entity incorporated by the Caja de Pensiones para la Vejez y Ahorros since it was founded.

Nowadays, CaixaBank is the result of adding a long list of entities to Francesc Moragas's original project and it has remained true to the committed values that inspired the founders. These values have turned us into a benchmark European bank; a leading and solvent bank that focuses on trust and profitability and maintains an unyielding commitment to society.

Death of Francesc Moragas, founder and CEO of the bank He was succeeded by the then-deputy director Josep Maria Boix i Raspall.

Since 1905, the Caja de Pensiones para la Vejez y Ahorros had grown extraordinarily, opening 109 offices, and it had a market share of 59.5% of Catalan bank deposits and 25.6% of deposits in the Spanish savings sector.

The President, Lluís Ferrer–Vidal, died and was succeeded by Lluís Serrahima i Comín. With the start of the Spanish Civil War, times were tumultuous and business at a standstill. Miguel Mateu i Pla, businessman and mayor of Barcelona, was appointed as the organisation's new President.

The bank began intense property dealings involving social promotions This meant that over 25,000 homes could be built forming significant patrimony.

The CaixaBank Social and Affordable Housing Plan, working with ”la Caixa” Foundation, is currently one of ”la Caixa” Group's most relevant programmes: it has a stock of over 30,000 houses that are offered for rent at under 500 Euros.

Computerization of the bank began The Electronic Accounting Service was introduced, keeping it ahead of its competitors in terms of mechanisation and data teleprocessing.

First bank in Europe to introduce real time teleprocessing in their offices The organisation's innovative nature shone through with this pioneering computerisation, a distinguishing key factor in its future expansion for the benefit of its customers.

With teleprocessing, customers could perform everyday operations in any office, choosing the branch closest to them at all times, almost totally unheard of back then.

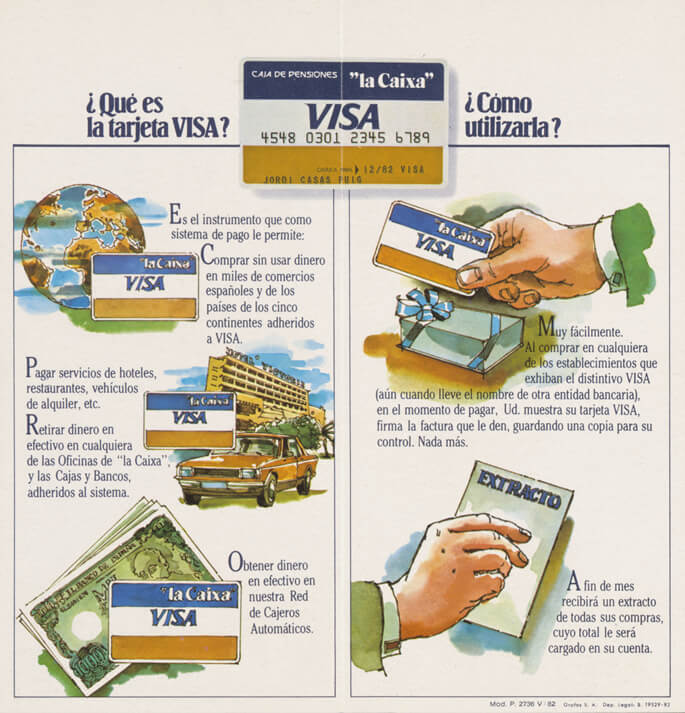

Launch of the first credit cards Customers were offered a new, easy and safe way of paying.

In addition, in line with the entity's bid for innovation, ”la Caixa” would go on developing this system to include shaped cards, personalised cards or prepayment cards, among others, in order to keep ahead of customers' needs in a versatile market such as payment methods.

ater, in 1998 ”la Caixa” would be the first European entity to issue all brands of cards (Visa, Mastercard, Amex, Diners and JCB).

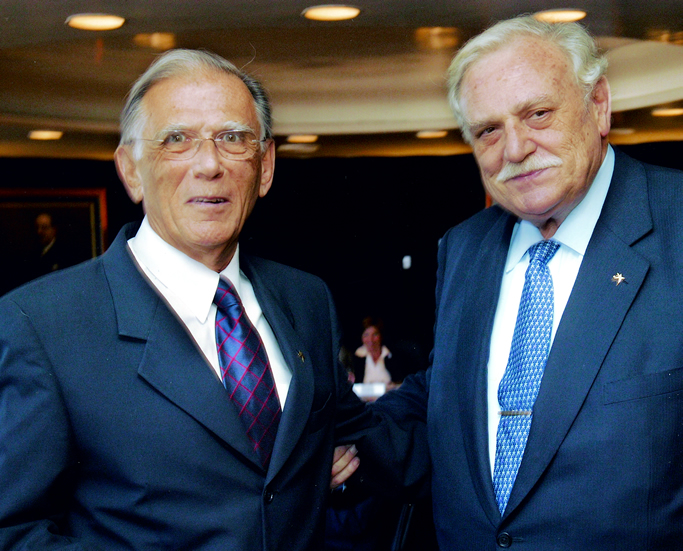

The President, Narcís de Carreras, who took over from Miguel Mateu i Pla in 1972, appointed José Vilarasau as Managing Director of the organisation His appointment was the starting pistol for what today has become ”la Caixa” Group.

Vilarasau started an in-depth process of modernising the organisation, supported by a management team whose talent and business outlook would lead them to play an outstanding role in the Spanish economy.

Ricardo Fornesa (1977), Isidro Fainé (1982) and Antonio Brufau (1988), along with Vilarasau, would be the four executives who would lead the organisation's growth strategy.

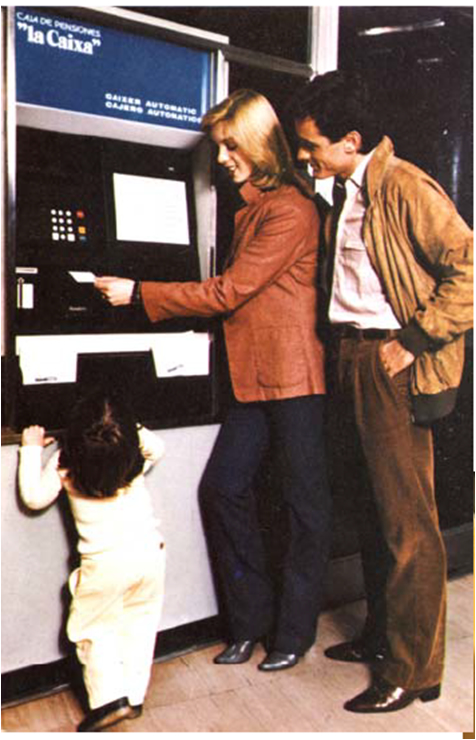

The first ATMs were introduced Intended to strengthen self-service, with a clear customer focus. Nowadays, the entity has the largest, most cutting edge network of ATMs in Spain, capable of carrying out more than 250 different transactions.

In addition, another outstanding milestone took place: the Palau Macaya, former headquarters of the Deaf, Dumb and Blind Institute, was transformed into the Cultural Centre of the Caja de Pensiones in Barcelona.

Start of a plan to invest in major service and infrastructure companies, all leaders in their sectors Subsequently, they would be grouped into a company that would be floated on the stock exchange.

In 1980, the organisation achieved two new milestones: Salvador Millet i Bel was appointed as President of the organisation and new headquarters for the Caja de Pensiones were opened in Madrid, at Paseo de la Castellana, 51.

The new Barcelona Science Museum opened to the public Intended to bring science to young people, the first of its type in Spain that soon became the second most visited museum after El Prado.

Opening this museum formed part of ”la Caixa” Foundation's bid to promote education and bring science to all citizens, particularly children.

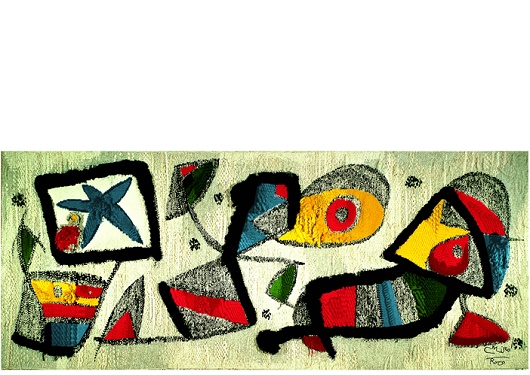

For the first time, artistic creation came into play when defining a company's visual identity and the star by artist Joan Miró became the entity's new symbol, thereby setting a milestone in the field of design and corporate image.

The star, dreamed up in 1980 and fully adopted in 1982, is still used today as a distinctive, differentiating symbol for CaixaBank and ”la Caixa” Foundation and the wall hanging commissioned to the artist currently presides over the lobby in the Barcelona headquarters.

The same year, the organisation's Grants programme began to broaden foreign studies, one of the longest-running schemes within the organisation which more than 3,000 university students have been able to use.

Architect José Antonio Coderch designed the bank's new headquarters on Avenida Diagonal in Barcelona The headquarters building still maintains its original structure to this day and it is an emblem of the city.

In addition, the organisation's management structure was renewed, Foundation activities were restructured and ”la Caixa” Foundation was set up.

GrupCaixa was set up, a company that grouped together all the group's financial and service subsidiaries

In order to accelerate expansion and work through, as yet, restrictive legislation, the organisation found an innovative and visionary solution by setting up this financial conglomerate to begin working throughout Spain as a whole.

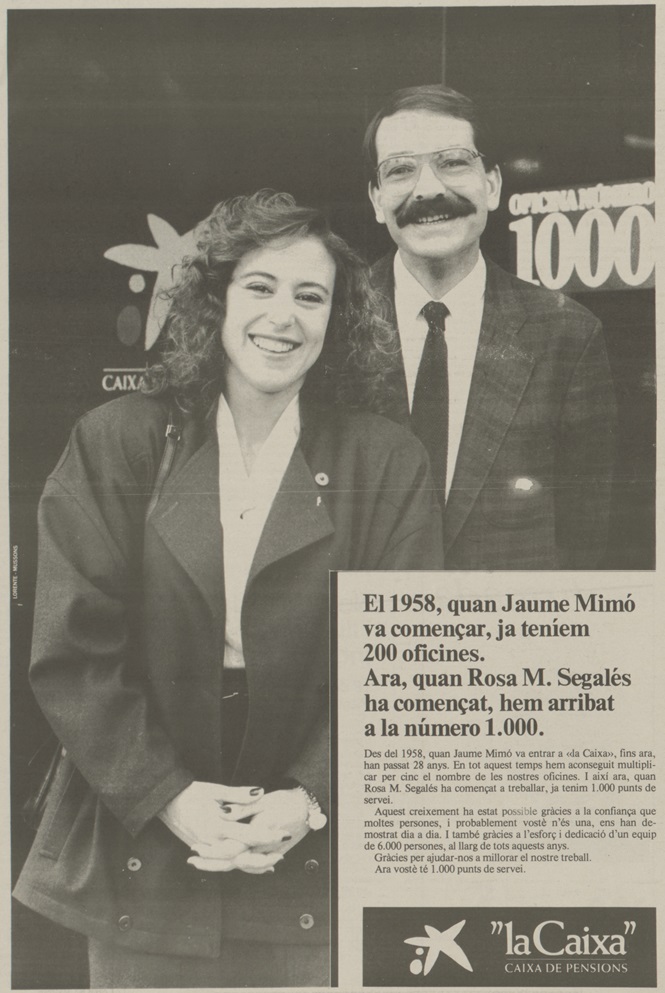

The organisation reached the milestone of opening 1,000 branches This capillary territorial structure, present in 100% of towns with more than 25,000 inhabitants, has also consolidated a model for incorporating progress in technological innovation, keeping one step ahead of other financial entities. Proof of this lay in implementing the first POS terminal in this year allowing customers to pay by card in shops.

Appointment of Juan Antonio Samaranch as President of the organisation Along with José Vilarasau, the executive steered the merger with the Caja de Ahorros y Monte de Piedad de Barcelona, creating ”la Caixa” and he consolidated it as the top savings bank in Spain.

With the new Law that disposed of geographic limitations, the bank incorporated the GrupCaixa network and business into its structure, thereby overtaking other banks in their expansion. It also purchased the network of 29 branches from the Banco de las Islas Canarias and finished the decade with solid bases to boost its expansion plan and business model definitively.

Constitution of the Caja de Ahorros y Pensiones de Barcelona This came about thanks to the Caja de Ahorros y Monte de Piedad de Barcelona (1844) merging with the Caja de Pensiones para la Vejez y de Ahorros de Cataluña y Baleares (1904), the third and first largest Spanish savings banks respectively.

José Vilarasau remained Managing Director of the organisation whilst Juan Antonio Samaranch was named President, a position he shared with José Juan Pintó, former President of the Caja de Barcelona.

After the merger, ”la Caixa” intensified its service and personal treatment policy by continually opening branches and a strategy for improving productivity and efficiency in distribution based on decentralising management and constant investment in technology.

José Vilarasau appointed Ricardo Fornesa, Isidro Fainé and Antonio Brufau as Deputy Executive Managing Directors, who would boost and make their name in the organisation's recent history

”la Caixa” business is mainly divided into:

Banking

Insurance

Financial companies

Stocks and shares

Property

The bank extended its international reach to Portugal.

This was done by acquiring 6.51% of the capital for the Banco Português de Investimento (BPI) group.

This thereby began a close relationship with a long term strategic outlook, in an attempt to support BPI and become a reference bank in Portugal.

The bank revolutionised customer services model in banking.

It pioneered removing glass screens at counters in its branches and introduced the first open branch model with personal service. To improve dialogue, physical barriers were removed that had prevented communication with customers and sales persons.

The ”la Caixa” website went online.

The organisation laid the foundations for Línea Abierta, its online banking service.

CaixaBank is currently the top national and international bank in terms of penetration of the online banking market.

5.1 million Online banking customers.

32.4% Penetration of the online banking market.

900 different operations.

*Figures updated in June 2016

Appointment of José Vilarasau as President of ”la Caixa”. Isidro Fainé became Managing Director of ”la Caixa” and Antonio Brufau, Managing Director of ”la Caixa” Group.

”la Caixa” ATM network grew massively in the 1990s, tripling its machines in 10 years. In addition, channels were progressively added such as telephone banking, the Internet channel and, more recently, mobile phones, in all modes, or digital TV.

CaixaHolding was set up to administer the relevant portfolio of subsidiaries and shares held by the entity under a single strategy.

Currently, CriteriaCaixa, subsidiary of the ”la Caixa” Banking Foundation, manages all the Group's share holdings in strategic sectors such as energy, infrastructures, services and property business, plus CaixaBank. The gross value of this portfolio exceeds 20,000 million Euros.

”la Caixa” launched ¿Hablamos? (Let’s Talk!) and opened CaixaForum Barcelona.

¿Hablamos? (Let's talk!) was a new communication concept based on the main aspects that made the bank stand out from its competition, used as a communication axis for the whole organisation's business actions.

Barcelona CaixaForum was also opened, as the new cultural centre for ”la Caixa” Foundation. Other similar centres were subsequently opened in major Spanish cities.

Ricardo Fornesa was appointed President of ”la Caixa”.

He was behind setting up a property company, a micro-finance agent and a finance agent for entrepreneurs.

Ricardo Fornesa provided a fresh boost to “la Caixa” Foundation, giving it a new social twist whilst he continued to expand the banking business that had been led by José Vilarasau over the previous few years.

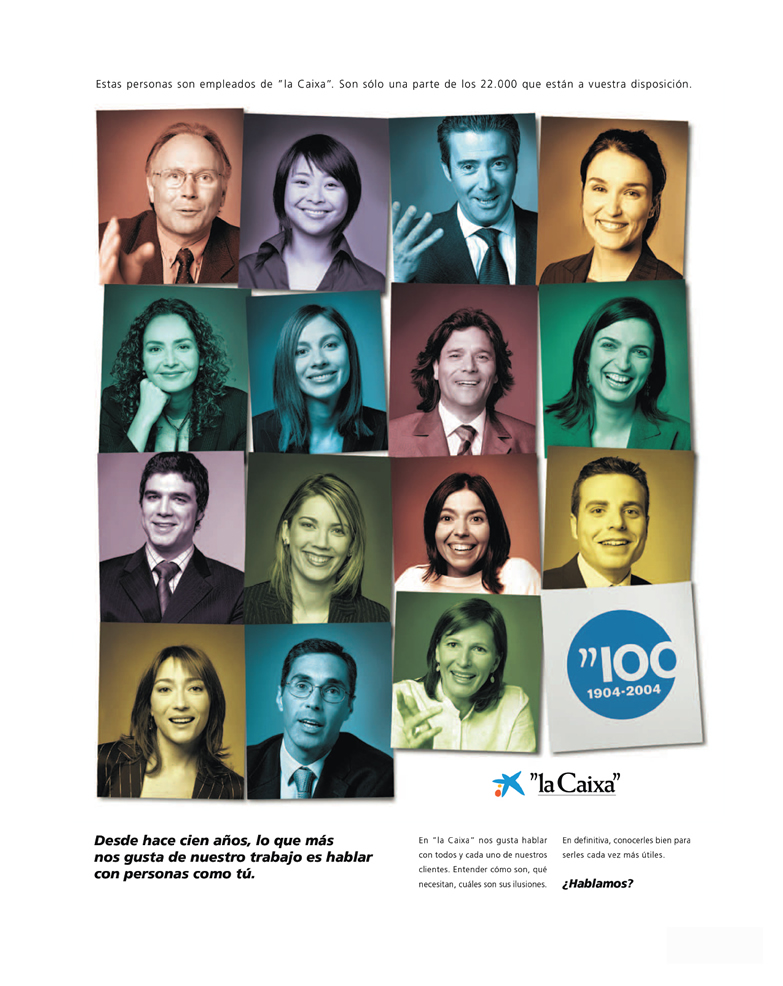

To commemorate the bank's centenary, ”la Caixa” organised a wide range of activities in all regions.

It designed a campaign to thank employees and customers for their loyalty, making them the real stars of the bank's success.

More than 1,700 employees volunteered to star in the TV and press adverts. Faced with the massive number of volunteers, auditions were held in 9 capitals, with unprecedented organisation of directors and cameras.

The organisation topped 10 million customers.

It became the leading bank in Spain, offering a specialised value proposal for each business segment. Its universal banking model, based on quality, proximity and specialisation, with a wide range of products and services on offer, all adapted to customers' different needs and an extensive multi-channel distribution network have all been endorsed by customers.

1 in 4 Spaniards are currently CaixaBank customers.

Isidro Fainé Casas was appointed President of ”la Caixa”.

During his presidency, ”la Caixa” became the leading entity in Spain and he strengthened the “la Caixa” Foundation, making it the second largest foundation in Europe.

The entity created MicroBank, the largest social bank specialising in micro-finance in Europe, intended for population segments whose financial needs are not covered, whether they are entrepreneurs, micro-companies or families. It operates via the CaixaBank office network to promote productive activity, creation, self-employment, personal and family development and financial inclusion.

This year, another key milestone was achieved: the portfolio of stocks in financial and industrial companies for “la Caixa”, Criteria CaixaCorp, was floated on the stock market.

”la Caixa” purchased the Morgan Stanley private banking division in Spain.

This purchase represented a decisive step to strengthen a strategic area for the bank.

This was the first financial year when the ”la Caixa” Group earmarked a budget of 500 million Euros for the Foundation. It maintained this budget over the coming years despite the recession.

Caixa Girona merged with ”la Caixa”.

This operation heralded 75 incorporations accumulated by the bank since it was founded.

What's more, ”la Caixa”, Telefónica and Visa chose Sitges (Barcelona) to begin the first experiment in making purchases using NFC (contactless) mobiles to take place in a Spanish city, demonstrating the organisation's capacity for innovation to benefit its customers.

After a long period of growth and expansion of credit in Spain, the recession demonstrated the over-capacity and weaknesses of its financial system that began a restructuring and concentration process never before seen in its history, dropping from 54 to 14 entities.

CaixaBank was set up.

”la Caixa” transferred its banking business to Criteria CaixaCorp (that became a banking group called CaixaBank) and the latter transferred part of its industrial shares and newly issues stocks to ”la Caixa”.

CaixaBank was floated on the stock market in July.

Civic Bank was incorporated into CaixaBank.

Civic Bank (Caja Navarra, CajaCanarias, Caja de Burgos, Caja Guadalajara and Cajasol) was incorporated into CaixaBank by means of a merger by absorption.

This operation made CaixaBank the leading entity in the Spanish market for assets, deposits and loans, and strengthened its position in Andalusia, Navarre, Balearics and the Canaries, offering high quality service.

Banco de Valencia merged with CaixaBank.

The technological and operative integration was completed in just five months.

After this operation, CaixaBank became a benchmark entity in the Valencia and Murcia regions, where it has a widespread office network.

”la Caixa” became Fundación Bancaria Caixa d’Estalvis i Pensions de Barcelona, ”la Caixa”.

This complied with the Law of Savings Banks and Banking Foundations dated 27th December and led to a reorganisation of ”la Caixa” Group. The “la Caixa” Banking Foundation manages the Foundation that has historically characterised ”la Caixa” and, through, CriteriaCaixa, ”la Caixa” Group's share holdings including CaixaBank.

CaixaBank announced the purchase of Barclays Bank S.A.U. and its retail bank, patrimony management and corporate banking business in Spain.

This operation was able to boost the personal banking and private banking business in Spain, strengthening consultancy for all customers.

Jordi Gual was appointed President of CaixaBank, whilst Isidro Fainé presided over the ”la Caixa” Banking Foundation and Criteria Caixa.

Gonzalo Gortázar, continued as CaixaBank CEO, following his appointment in June 2014.

CaixaBank presented imaginBank, the first mobile-only bank to be set up in Spain and the first in the world where transactions are performed exclusively via apps for mobile phones or social media.

CaixaBank announced a takeover bid for BPI, this operation is on-going.

In February, CaixaBank will finalise its takeover of BPI after obtaining an 84.51% share of the Portuguese financial institution. As such, CaixaBank will become the leader in retail banking on the Iberian market.

In October, CaixaBank’s Board of Directors decided to move the institution’s registered offices to València to fully preserve the legal and regulatory security intrinsic to its business and to protect the interests of its customers, shareholders and employees.

CaixaBank closes the year with a 100% stake in BPI. The Comissão do Mercado de Valores Mobiliários (Portuguese Securities Market Commission - CMVM) approved the delisting of the company, after which CaixaBank purchased the shares under the sell-out procedure. In the whole of 2018, the contribution of BPI business to CaixaBank's returns amounted to 262 million euros and, with the contribution of investee companies, 380 million euros.

In parallel, the company presents a new Strategic Plan 2019-2021 with the aim of moving forward in its position as the financial group with the best customer service and a benchmark in socially responsible banking. CaixaBank continues to improve its market shares and penetration in retail banking, and has consolidated itself as a leader in innovation, with the largest base of digital customers in Spain.

Best Bank in Spain 2019

Bank of the Year in Spain 2018